August 2025 Market Update

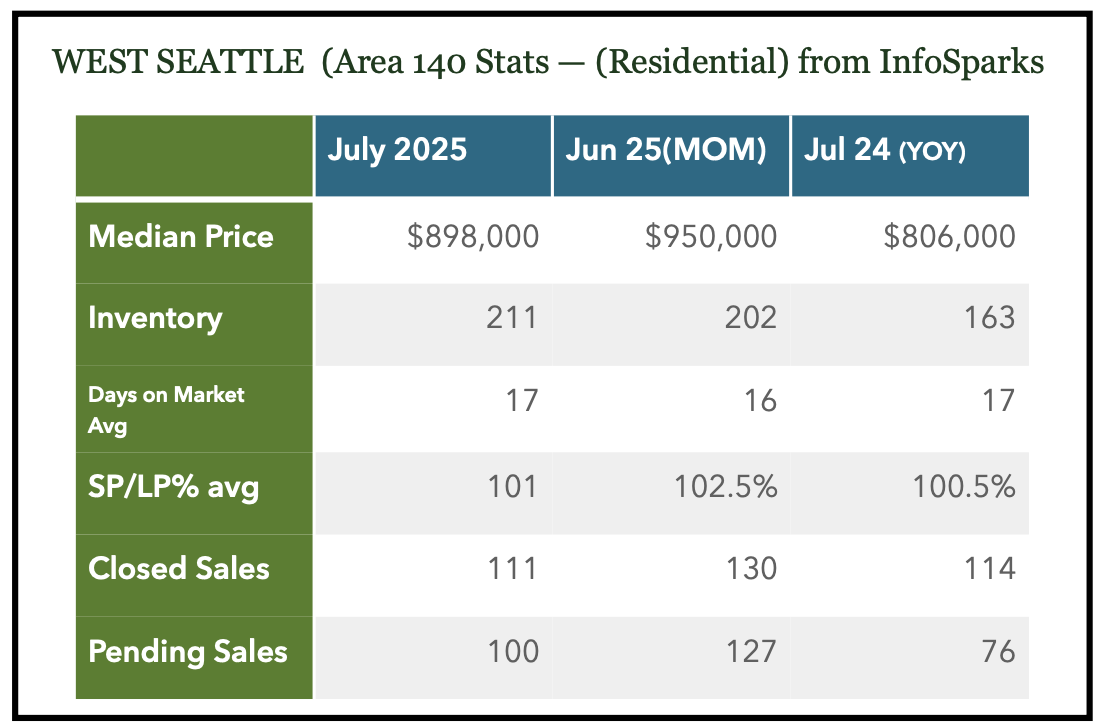

Following a year high Median in June, prices started their annual summer retreat. July and August are typically the time of year we see inventory grow, sales drop and pricing level out or decline. This summer seems to be following seasonal trends as median price dropped month-over-month, from 950k to 898k (which is still pretty high). Inventory numbers hit their peak in July with 211 and closed sales were similar to a year ago at 111. Pending sales (indicates recent activity, houses going under contract in the past couple of weeks) was still fairly strong at 100. These data points look at residential sales data, excluding condos.

Median price fell last month but remains fairly elevated. We historically see prices peak in late spring-early summer and then fade before getting a bump in September-early October. This is a ‘second’ selling season as buyers come back from vacations, we see better inventory (new listings), and good showing weather (it’s still light out, things green up again). Pricing historically fades in November-January before ramping up in late-Winter and early spring.

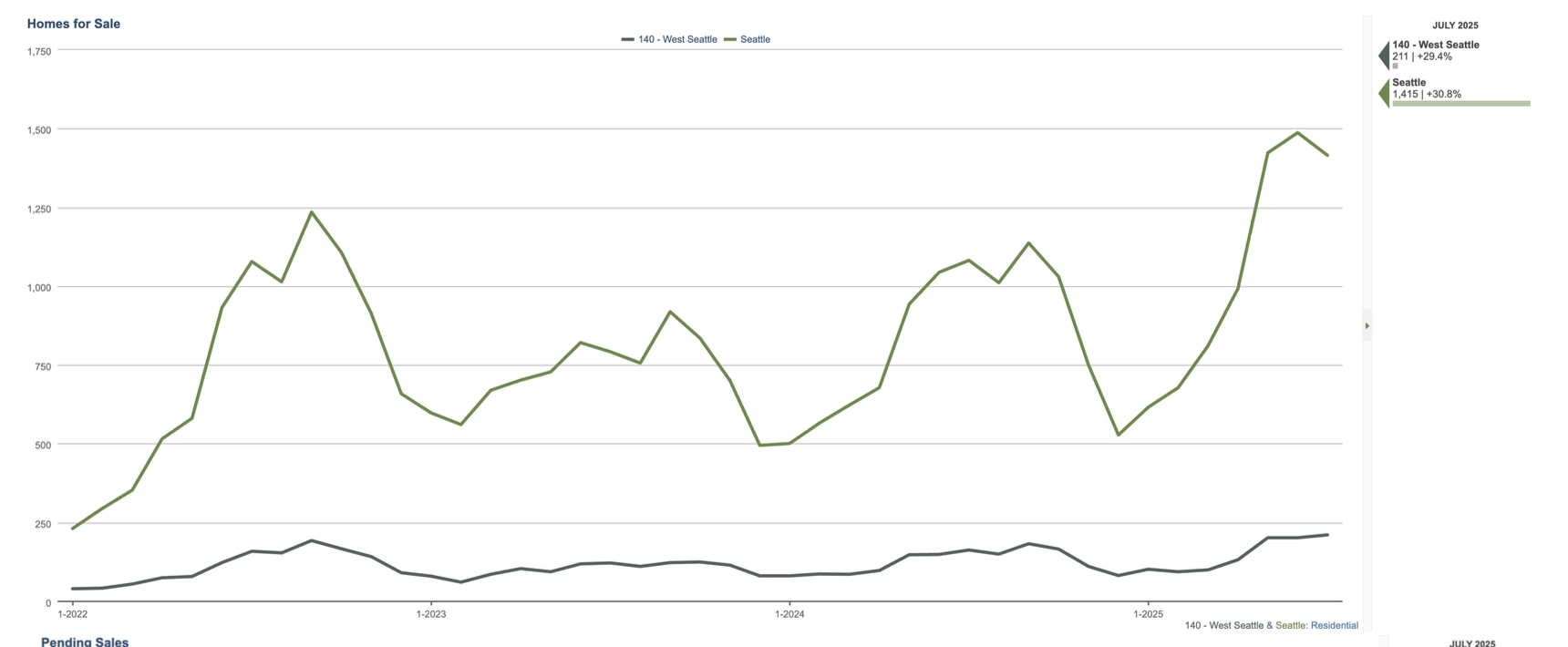

Inventory was up a touch in West Seattle with 211 (about the average homes available on the market every week). There were only 195 new listings last month compared to 276 in May and 226 in June. Much of that inventory got absorbed (accepted offers) and much of the existing inventory has been sitting on the market for a bit. The average days on market for active homes is 44 compared to just 17 for sold homes. So, while some homes are still selling quickly even more are sitting on market.

Closed sales typically wane as we get into summer months. June was a peak for closed sales (properties likely going under contract in May). While July was down month-over-month, it still was around April (106) and May (107) numbers. That’s still a pretty busy month.

The over a million dollar range is still really active and the major driver of this market. Sales price/list price ratios were at 101%. 41 homes received over 100% of asking price and 34 received less. There are still some pretty competitive offer situations out there but homes sitting on the market for more than a couple of weeks will be subject to price reductions and/or concessions.

Pending numbers stayed fairly high but do typically fade as we get later into the year. The selling season was a little late this year, May-June vs. April-May, likely due to a later spring break. August can be a little slow but September-early October can pick up. We can see buyer activity pick up as there can be a last push of good listings (better conditioned, preferred location, strategically priced).

Seattle Metro is following similar seasonal trends, month-over-month decline in price and sales (but still relatively high). The pending numbers indicate a real active market though so will be interesting to watch and see what they are buying. The previously owned pending numbers have been really strong this year. We felt that many sellers had been experiencing the locked-in effect the past couple of years , holding onto their low interest rates and not selling. It seems, more owners decided to get on with it (rates don’t look to be dropping any time soon) and put their home on the market. And despite higher interest rates, buyers are buying them. Also, New Construction project pending numbers were a tick up last month, so there were more townhome sales. Builders are sometimes able to offer lending incentives on those products.

Interest rates remain about where they were a month ago. 30 year conforming rates were at 6.630% and jumbo at 6.694%. VA rates are lower at 6.185%.