September 2025 Market Update

As summer nears its final couple of weeks, we take a look back on August numbers. Historically, August can be a slower month for activity. Median numbers can peak in spring, late summer and activity starts to wane in late summer. But the numbers look fairly consistent with the past couple of month. We did see less pending and closed sales from the previous month but on par with a year ago. Median price was still relatively high (similar to July) and about 3.5% higher than a year ago. There might be a couple of reasons the median remained high and we’ll look at that in a bit. Inventory numbers have been staying fairly consistent the past couple of month with just over 200 homes available.

Looking forward, September can be a second selling season. We typically get a new wave of inventory after Labor Day thru mid October and buyers become a bit more active. We can see ‘better’ inventory. These are homes that are strategically listed, better conditioned and priced. For sellers, well conditioned homes can show better with the still ‘good’ weather and its still lighter later (sun sets after 7pm). Buyers, who missed out on in the spring market and took the summer off, can come back to the search. We tend to see a slow down as we get into the darker months and folks turn their attention to the holidays.

Why are prices still so high? In West Seattle, the median price is still fairly high at just over 900k. You can see previous later summer numbers can sometimes take drastic drops. Part of the reason, as we have touched on in previous updates, is more homes over 1M are selling. The average home sale in West Seattle in August was $1,084,300.

Another factor could be that 6 homes closed over 2M last month, including the most expensive home selling in West Seattle at $6,500,000! It is the 2nd most expensive home sold in our area in recent history . It is also the first, as this home also sold for $6,747,000 in 2022.

The second most expensive home selling this past year, in West Seattle, also closed last month at $3,750,000.

Inventory numbers have been consistent the past couple of month, with existing inventory just over 200 homes available . However, a sizable chunk of these homes are townhomes and ADU/DADU styles of homes. We have seen homes sitting on the market longer, averaging 28 days last month. Side note, its interesting to look at the Seattle metro drop in inventory. We might take a look at that at some point and see why.

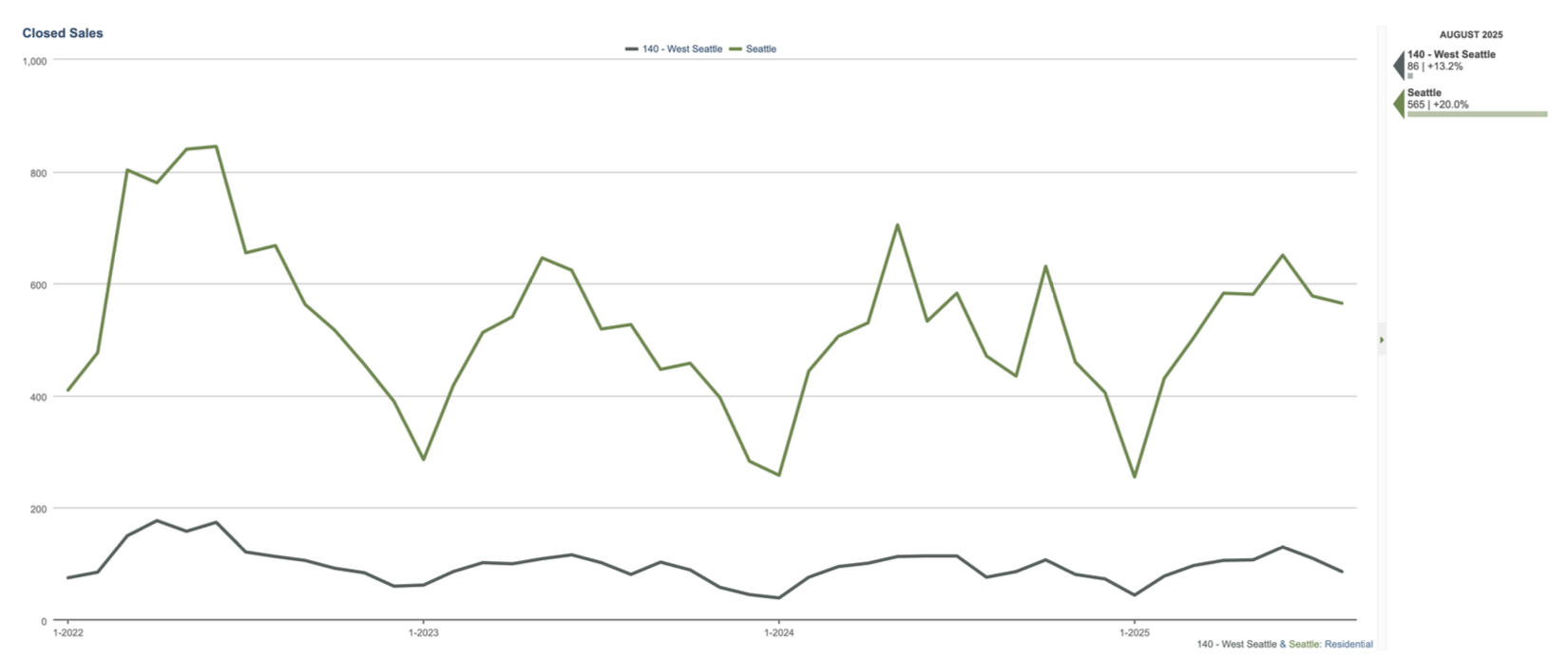

Closed Sales - There is still a strong demand for residential homes and we do see these homes selling more quickly and often with escalators. About a quarter of sold homes last month had higher than 100% list price/sold price ratios.

Pending numbers typically trend down in August and this year was no different. Buyers are often enjoying the last of summer and August is not a typically strong month for new inventory. There were only 123 ‘new’ listings in August compared to May (peak) when there was 209. We expect more homes hitting the market in the next couple of weeks. Pending sales historically get a little bump late September-mid October.

Seattle Metro followed seasonal trends. August saw a small drop from the previous month but over a year ago. We had thought there would be more activity (listings and sales) this year as sellers getting over the ‘locked-in’ effect and buyers taking advantage of better inventory. Median price is still high despite the persistent higher interest rates. Rates did start to trend a little down this past month, with a 30 year fixed at about 6.5% (compared to close to 7% in July).