February 2026 Market Update

Last Monday, Punxsutawney Phil came out of his hole and forecasted 6 more weeks of winter. But with pretty mild temperatures this past week it is starting to feel like (really early) Spring. January followed the overall real estate recent market trends with lower prices and less closed sales. But, we did start to see a slight uptick in inventory and pending sales. This seems to be following the past several year trend of January being ground zero and the market building as we head into February and March.

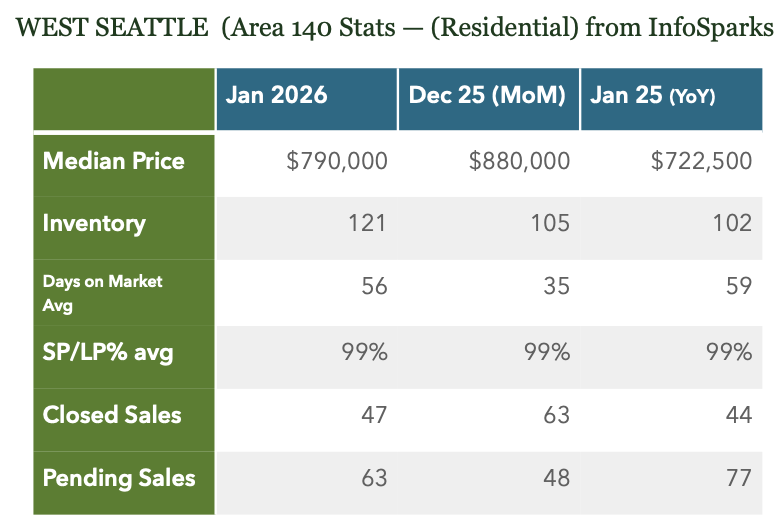

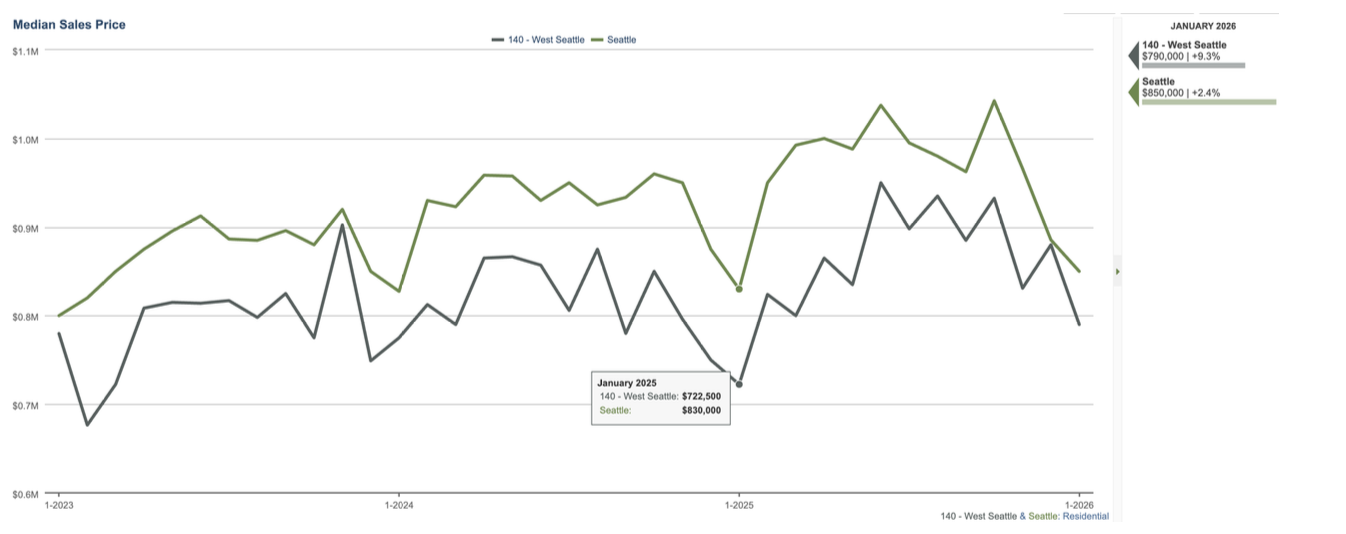

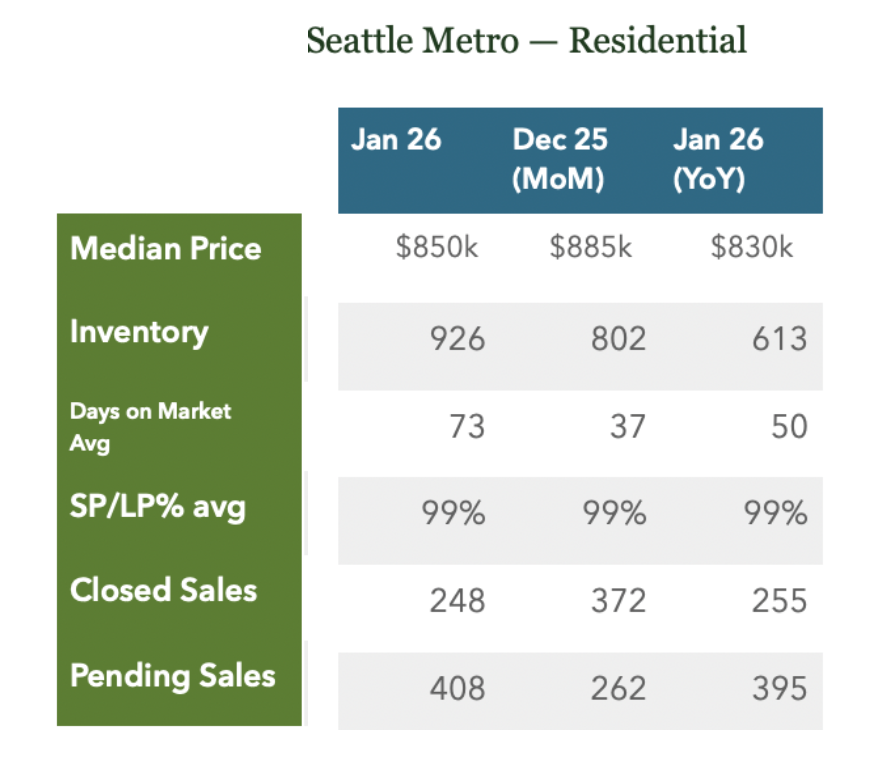

Median Price has typically bottomed out in the Winter months the past several years (and historically) and this year was no different. Overall Sales for these months tend to be less and homes, that have sat on market, finally sell. Average Days on Market for West Seattle closed sales was 56 days (and 73 for Seattle Metro). Average Days on Market was 18 last April (and a median of 6) for comparison. Also, Closed Sales tend to be homes that went under contract the month prior (December). It is a kind of out with the old and in with the new when it comes to winter sales data. We would anticipate Median to grow next month as ‘New’ Inventory starts to hit the market.

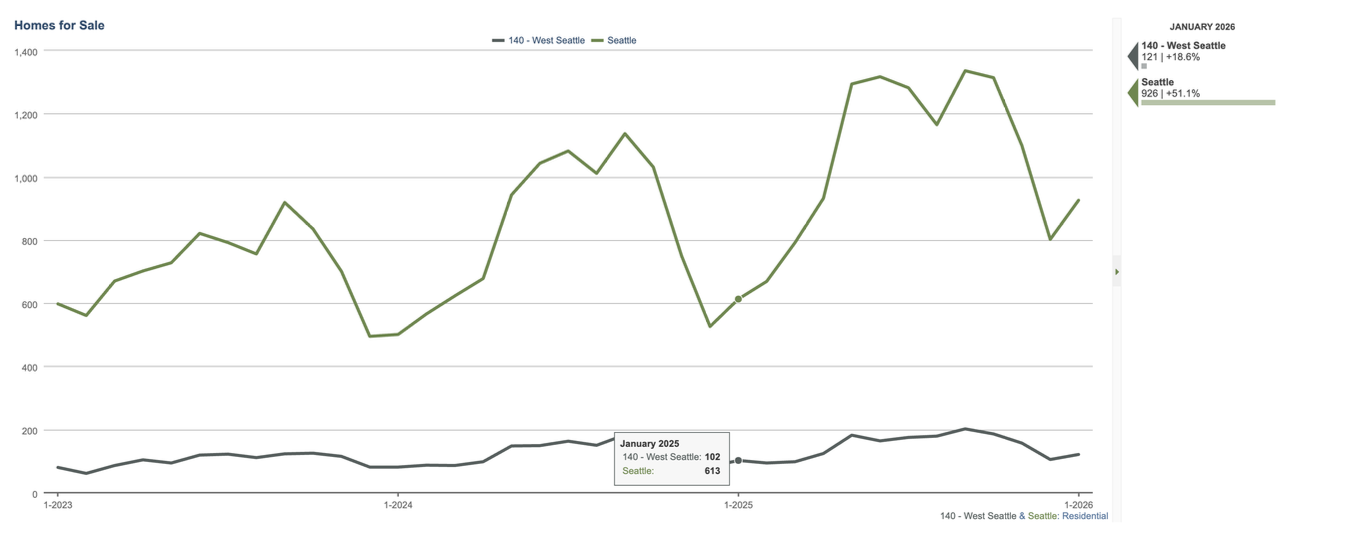

Homes for sale did start to change course, after a several month of decline, in the middle of the month as we started to see more ‘New’ Inventory hit the market. We saw 113 New Listings come to market in January, up from 25 in December. This is a trend we have seen the past several years where homes have been coming to market earlier and earlier, just after the new year. The past couple of January’s have been really mild weather wise so sellers have taken advantage of better weather and lower inventory/more demand market conditions.

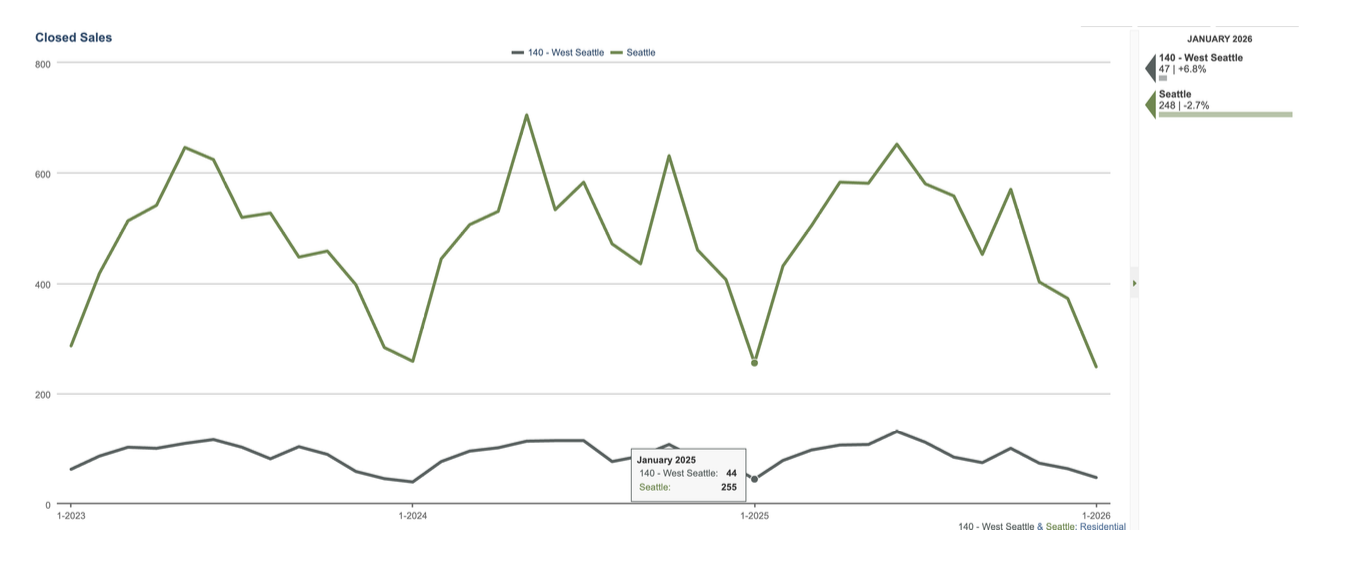

Closed sales typically start their climb this time of year and January was no exception. 2023-25 had fairly similar tracks and expect the next couple of months to follow suit.

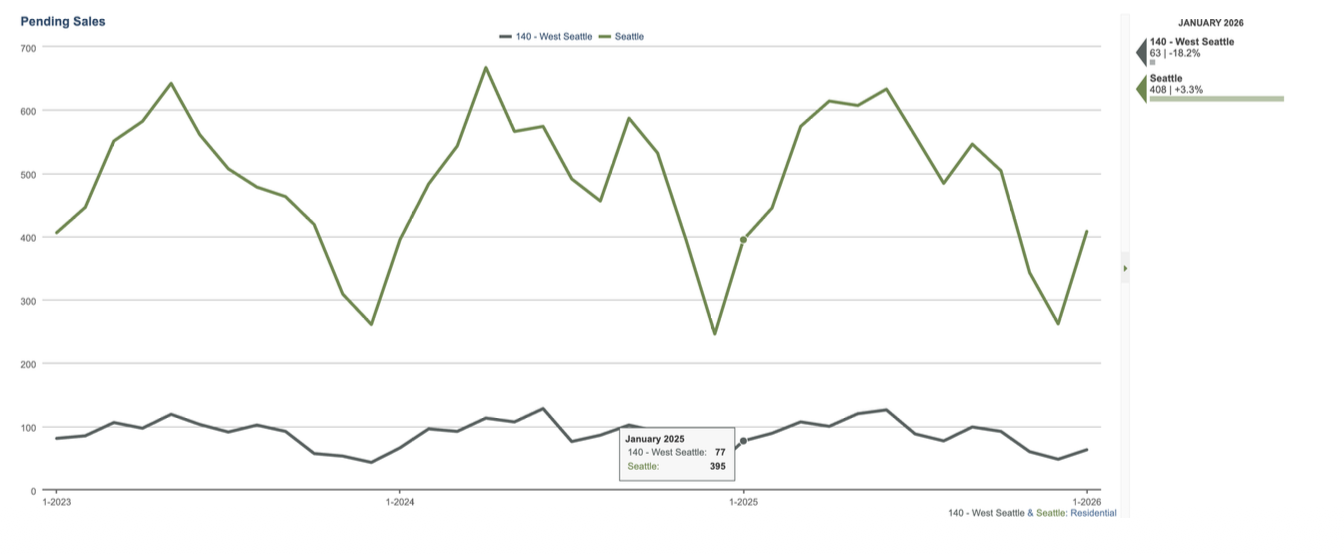

Pending numbers were also up, ever so slightly. With more ‘New’ Listings expected this month, that number should rise (even with a shorter month and the Seahawks taking up our attention).

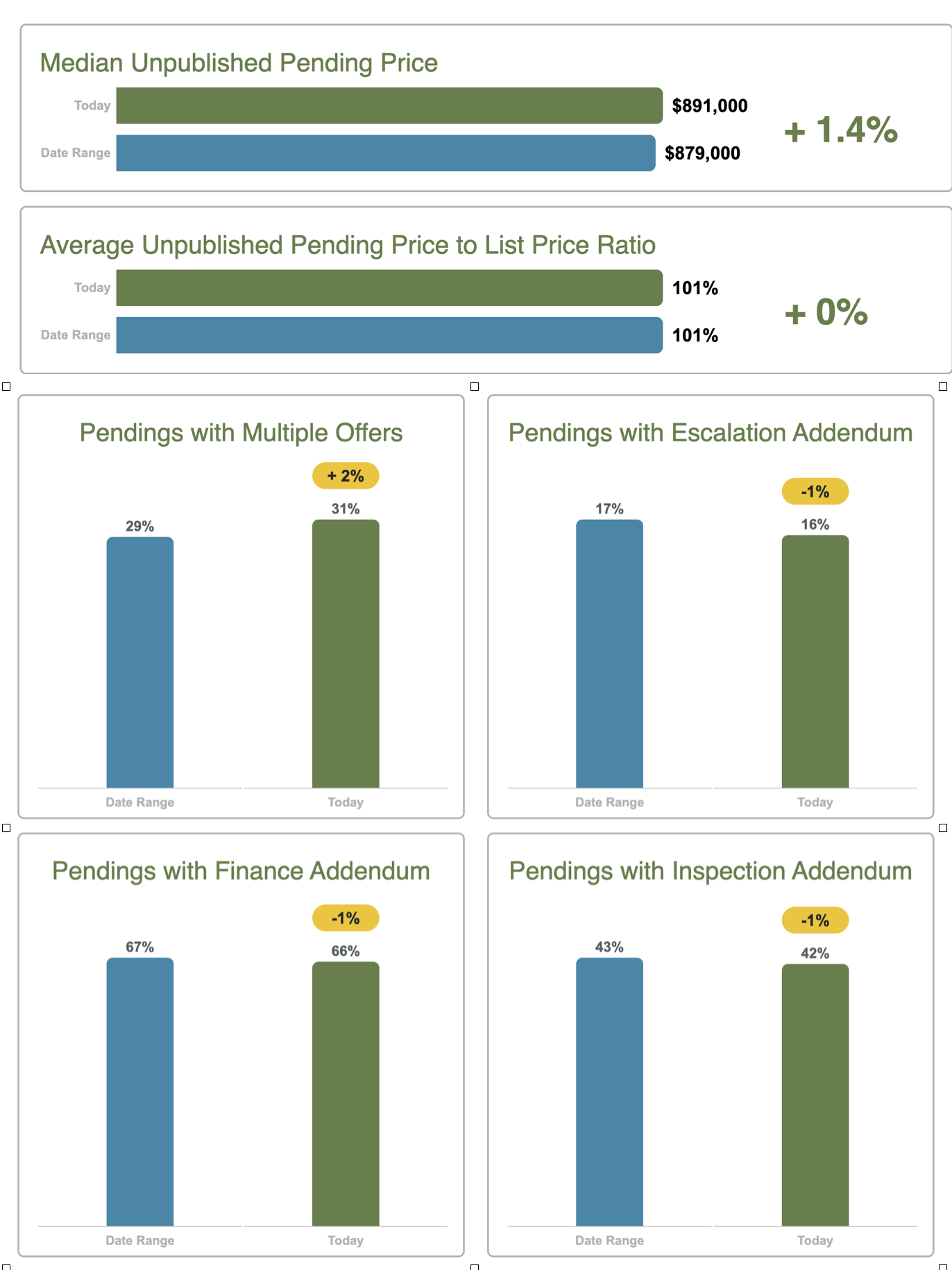

Here is different look at current Pending numbers. This is for Seattle Metro but gives a good idea of real time data of accepted offers. Pending numbers show Median Price is rising (was 850k in December). Sales Price/List Price Ratios are over 100%, 31% of offers were Multiple Offer situations and 16% had escalators. But 42% had Inspection Contingencies. Looks like a more balanced market. That could shift as hit the Spring market and things get a bit more competitive. We see more buyers in this market but we also see some of the best inventory. Sellers often strategically sell in these months and get their homes in the best condition and list at times when buyers are more active.

Seattle Metro mirrors West Seattle data with lower price and closed sales but higher Inventory and Pending sales. Those numbers should start going up the next couple of weeks and peak mid-year.

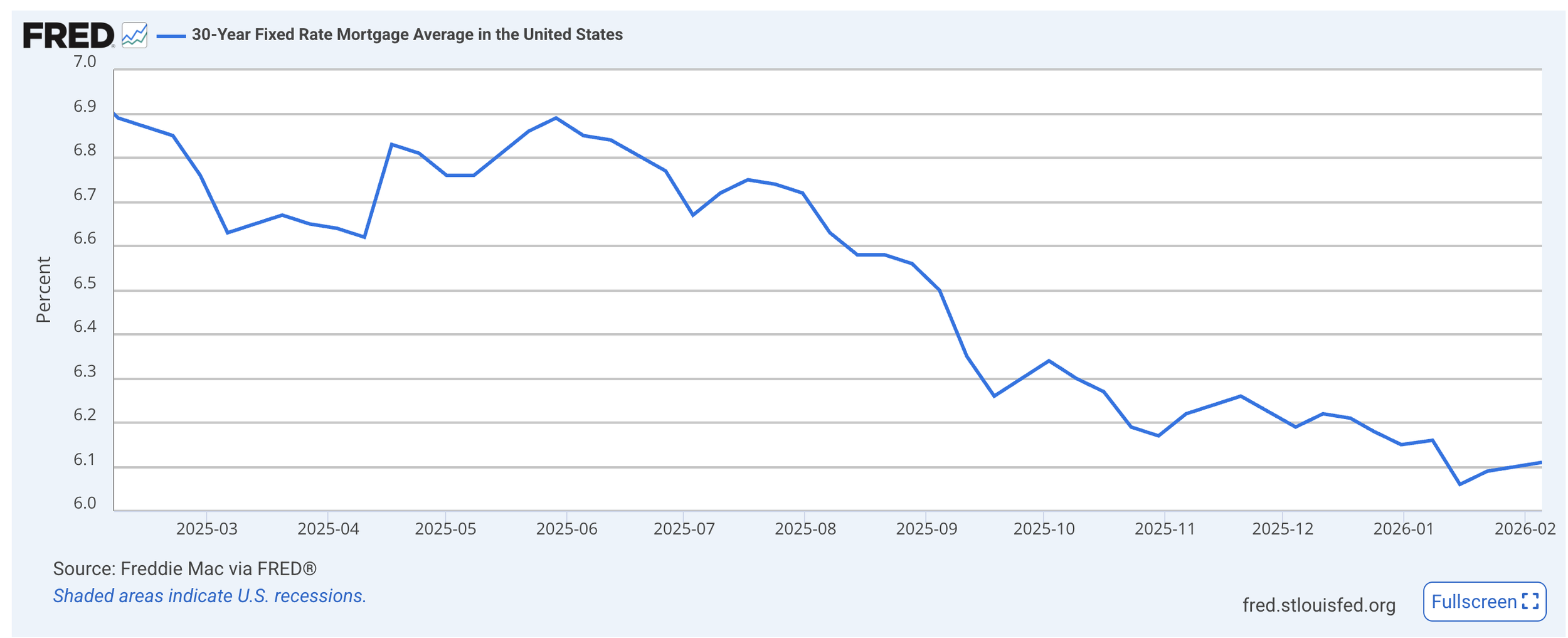

Interest rates have stayed fairly steady the past couple of weeks, around 6% for a 30 year product. We have seen a rate with 5 in front of it a couple of times. So, better than a year ago when we were closer to 7%. These rates are expected to stay through 2026. We’d expect a lot of buyers that have bought the past couple of years at near 7% to refinance. The rule of thumb is a .75-1% (or more) reduction in interest rates is a good time to refinance (with about aa 2-3 year breakeven period). Being closer to 6% might also help some of the home owners decide to put their homes on the market, that had rates of 4-5%. It still might be hard for borrowers with rates lower than 4% but its a start.

We have forever said, the Spring market starts after the Seahawks are done playing or after the Super Bowl. Well, let’s hope the Hawks win the big one this weekend! And, we’d expect the market to start its annual climb. Go Hawks!