2025 Market Review

2025 was a decent year market wise. Despite overall higher costs of homes and higher interest rates the market has stayed fairly resilient and on trend over the past 3 years.

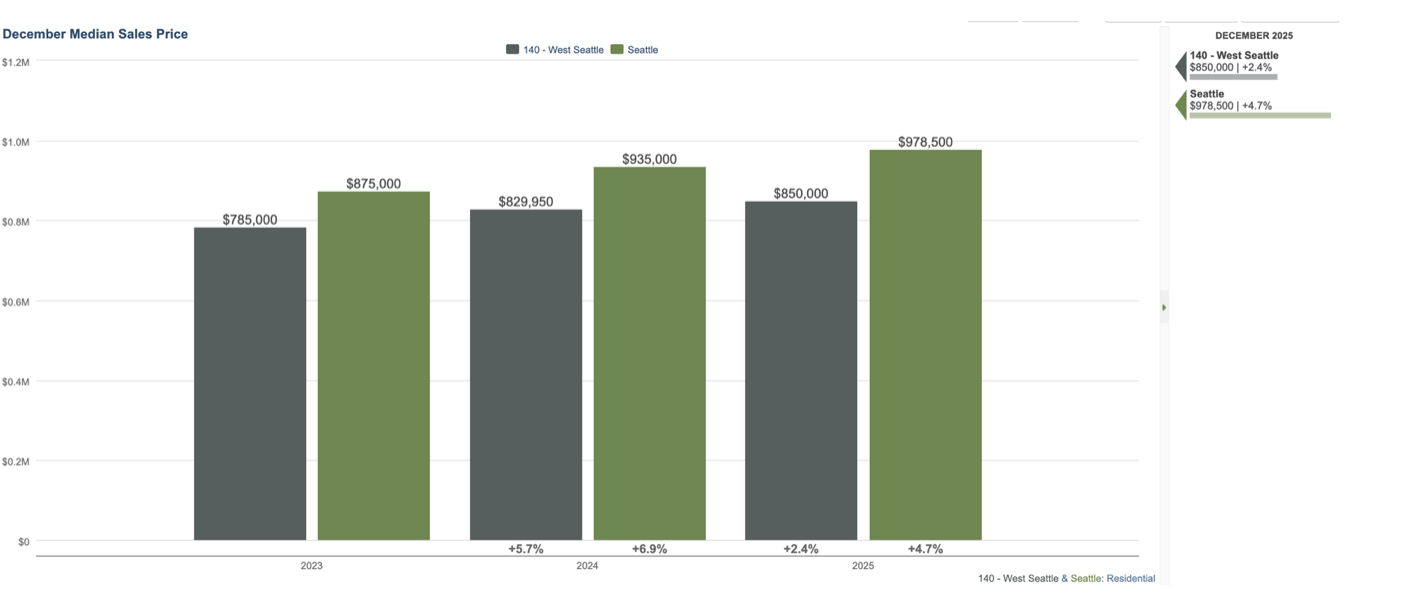

The Median in West Seattle was $850,000 vs. $829,950 in 2024, for a 2.4% increase. West Seattle followed the overall metro trends of year-over-year gains. This data is for residential homes and there has been some discrepancy in what is a residential home and what is condo the past couple of years. Many of the new construction projects (Townhomes, Attached homes, ADU and DADU) have fallen under a condo category so aren’t necessarily captured in this look (condos covered below). So, that residential home (selling for 1.5M) with an attached ADU (900k) and backyard cottage (700k) might not be reflected here. But, overall pricing was up for the year and on trend with the past several years. Seattle Metro saw a healthy almost 5% gain.

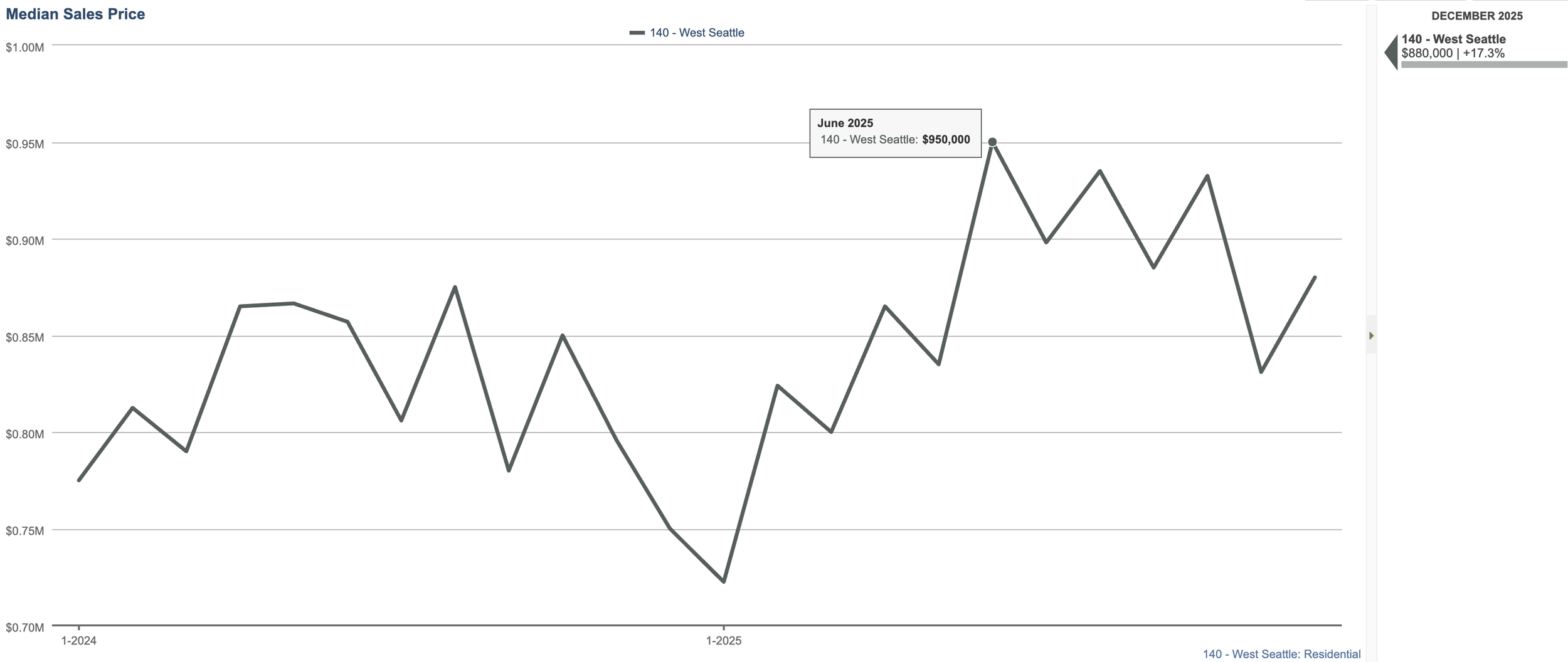

West Seattle Median price bounced around a bit through out the year but followed seasonal trends. Spring and early fall markets are typically the most active. Peak Median price was in June at 950k and August and October at around 935k. Lower prices were in January, 699k, and in November, 831k. This number is often for a smaller closed sales count, 33 in January and 65 in November vs. 131 in June and 100 in October. So, lower prices can also mean lower sales activity.

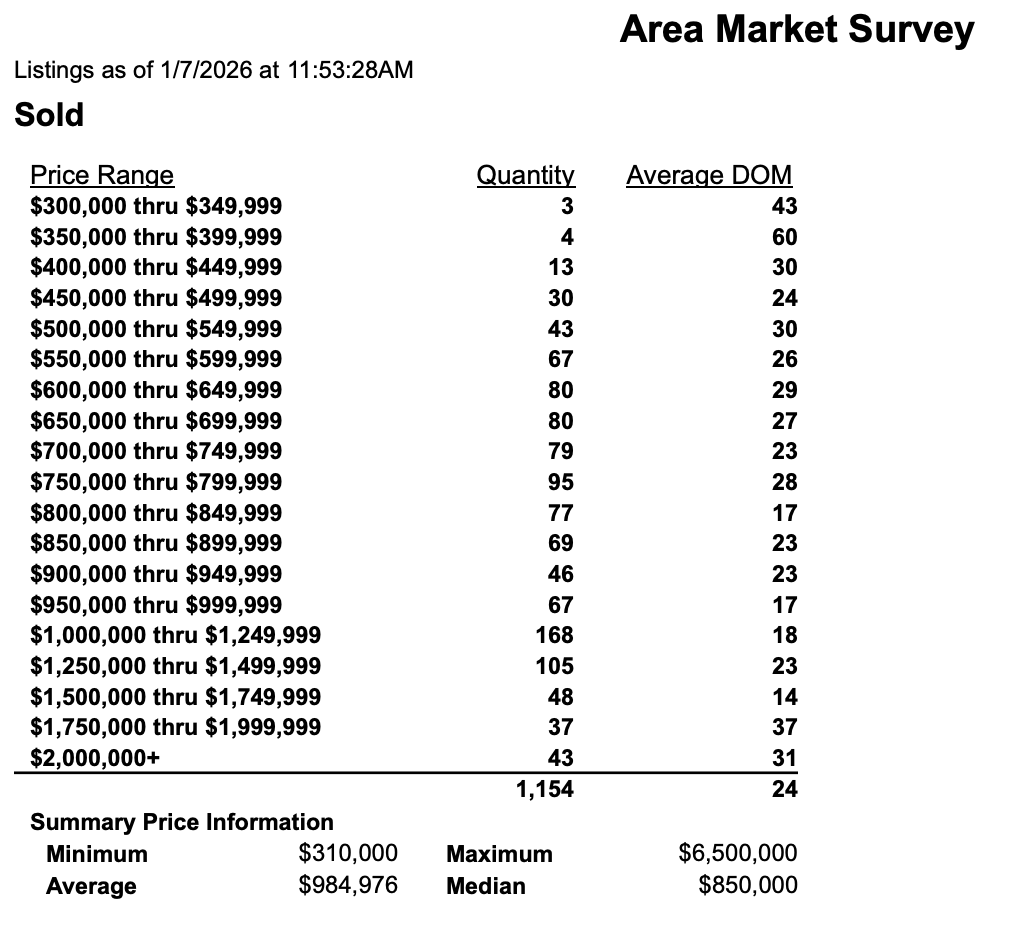

Price Range Breakdown - There have been a lot more expensive homes selling as well. There were 168 homes, priced between 1-1.25M, sold in the past year. The 700-799k range was also very active at 174 total sales.

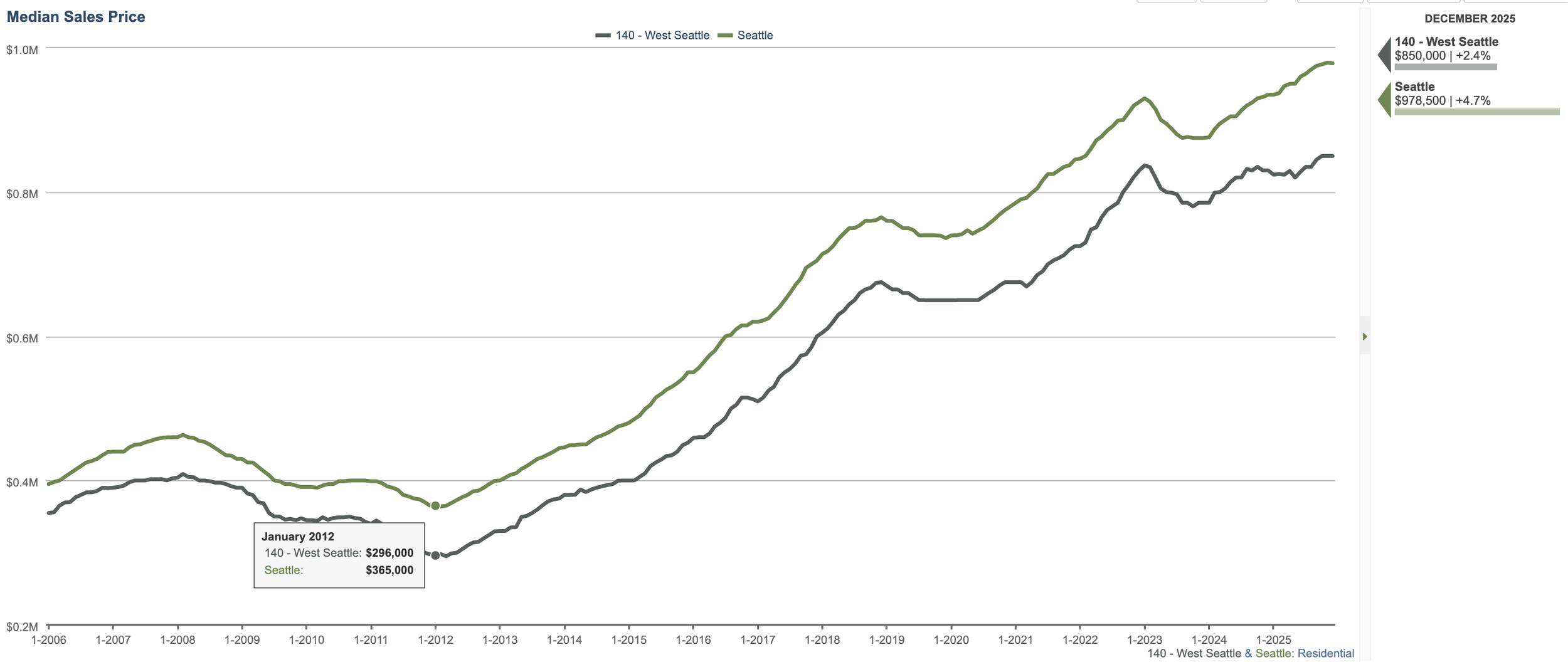

A 20 year look back at Median shows pretty consistent gains. 2006-2007 was a pretty competitive market in the Seattle area. 2008-2011 was the housing bust and 2012-2018 was a market that was recovering. We saw decent gains in those years. 2019 was market by more inventory (more supply than demand) and 2021-2022 with ulta-low interest rates (sub 4%). And the past couple of years, more demand than inventory. This massive gain over the past 10 years in pricing (the median was 400k in December of 2015) might help explain the affordability issue we see and hear about. Prices doubled in that span.

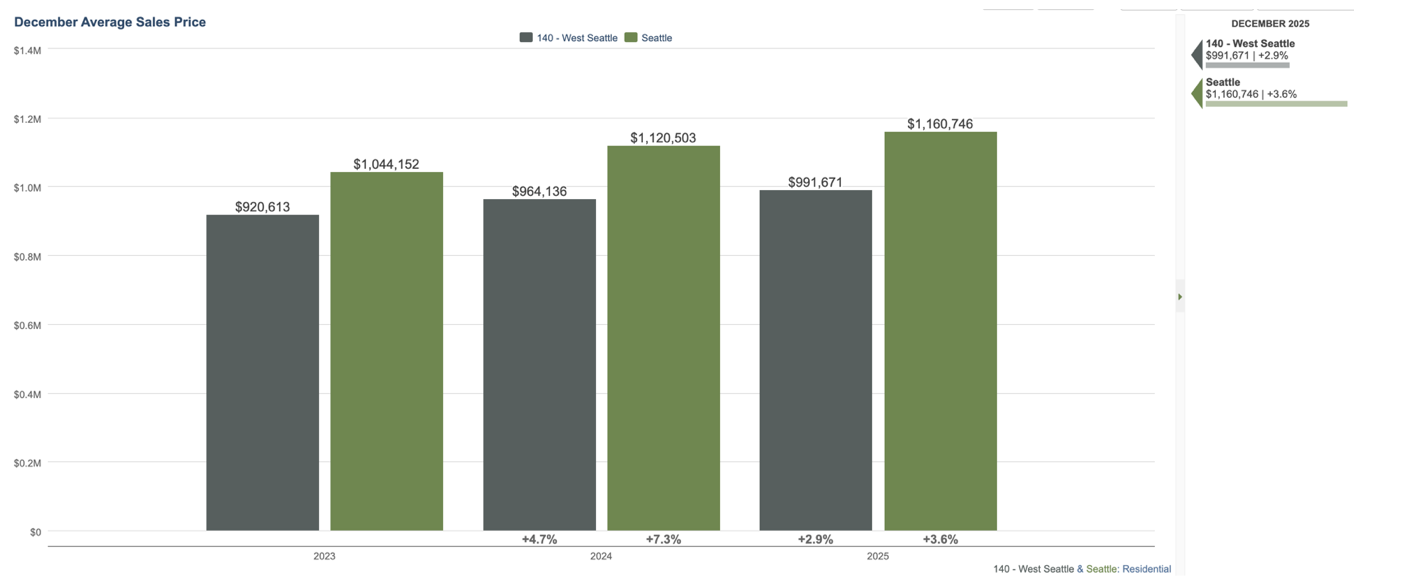

In the above charts we looked at Median Price, which looks at the mid-way point in pricing. We feel a big reason for the rise in Median is more expensive homes are selling. Looking at average price of closed sales shows this with West Seattle average prices at $991, 671 and Seattle Metro being well over 1 Million dollars. The average home price in West Seattle in December of 2014 was at 453k.

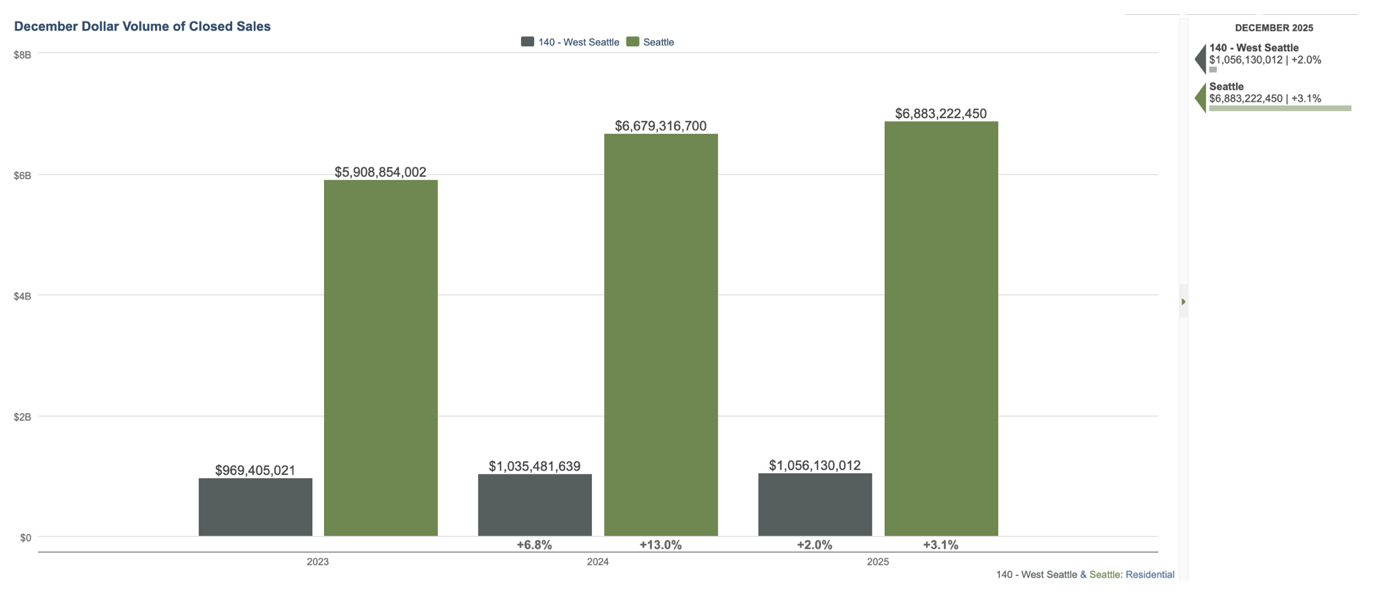

Over 1 Billion dollars of real estate closed in West Seattle last year and almost 7B in Seattle Metro.

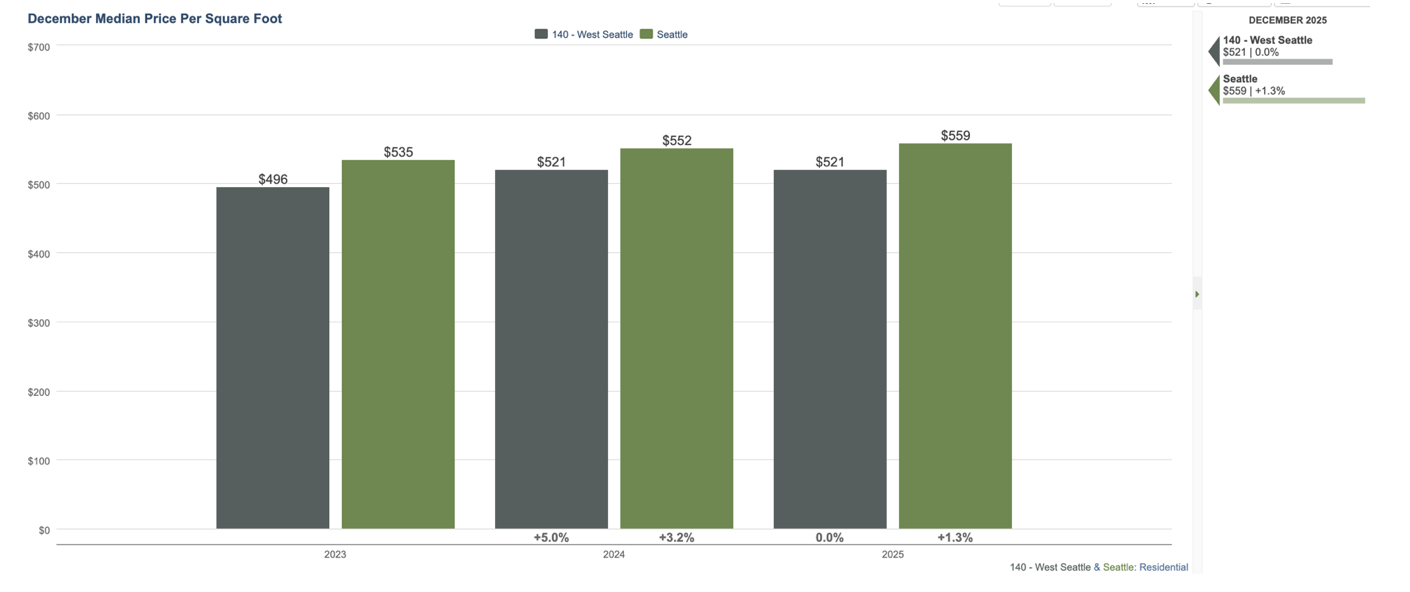

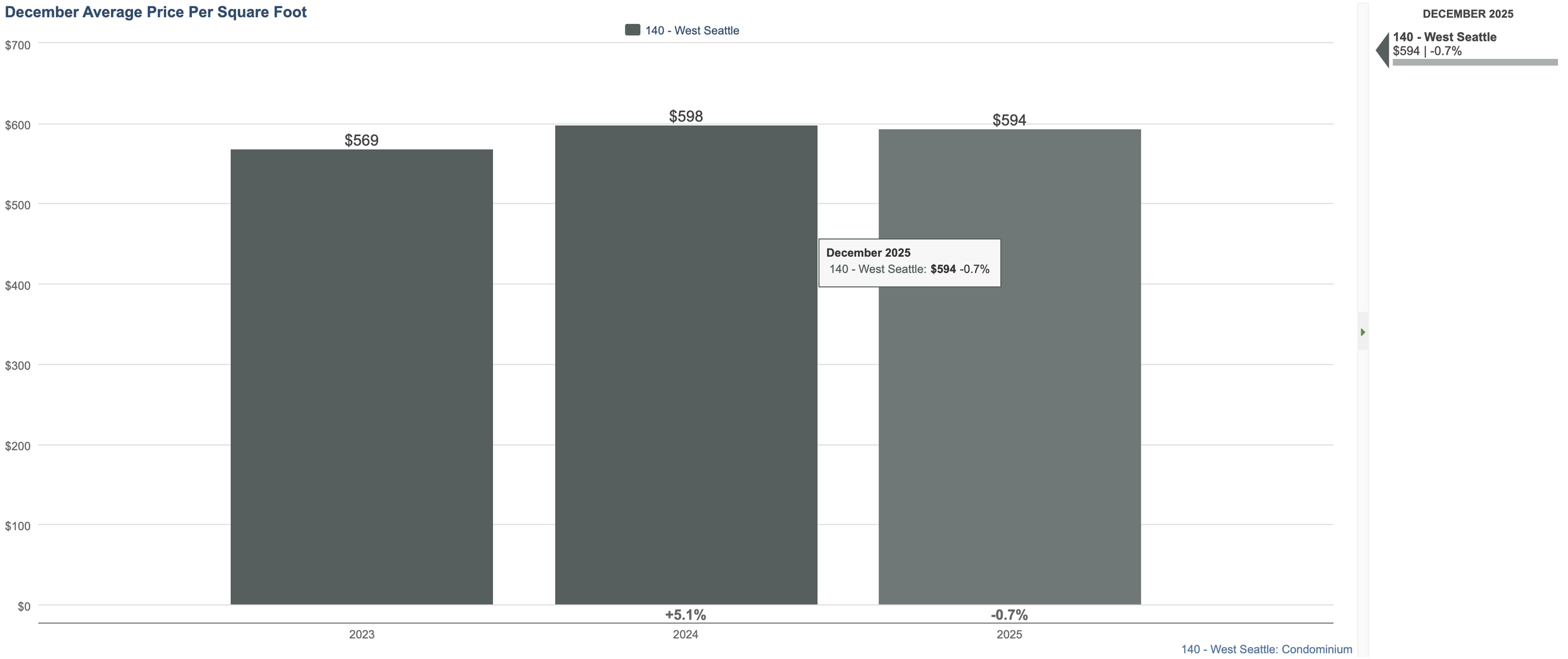

Price per square foot is not always the best indicator for residential homes (as many times unusable or unfinished space is calculated) but still interesting to consider. This has stayed fairly consistent the past couple of years.

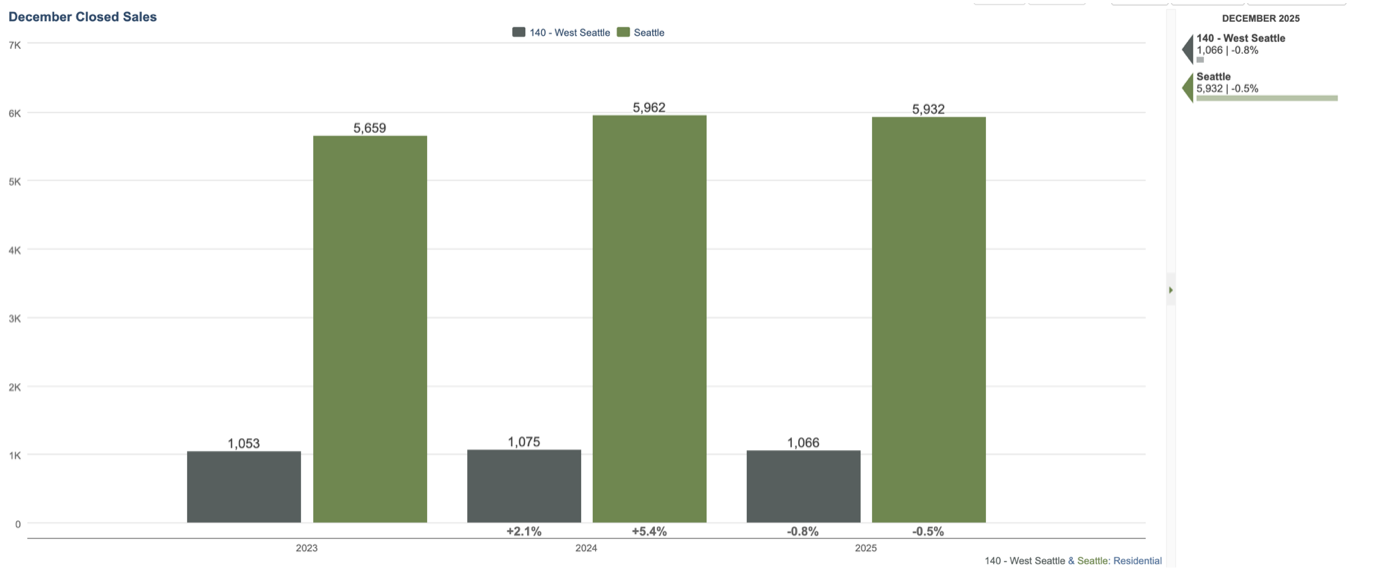

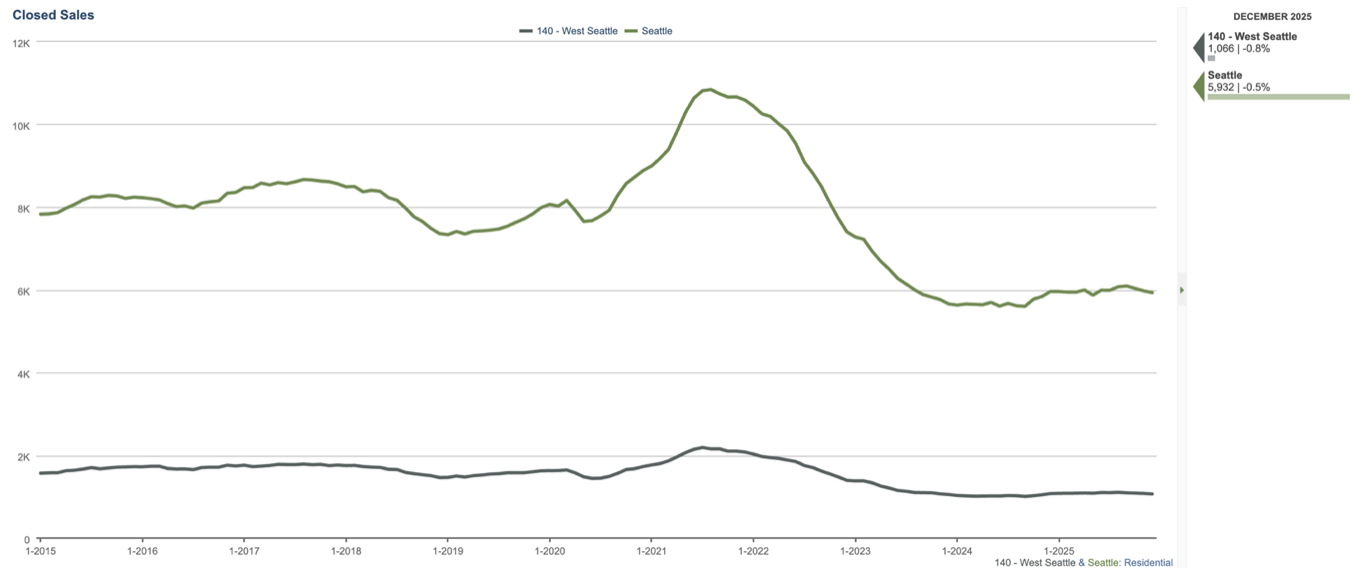

Closed Sales - 2025 looked a lot like the 2 previous years in West Seattle closed sales.

Closed sales the past 3 years do seem below pre-2022 numbers. 2022-2025 has been much lower than pandemic years (2020-2021) and under 2015-2019 averages. Note - there were 1,726 closed residential sales in 2015. 2022-25 has been a period marked by a higher interest rate environment. Higher interest rates have led to lower inventory. Home mortgage rates are currently in the low 6%s after being near 7% most of 2025. For comparison, interest rates were around 4-5% in the years between 2015-2019 and under 3% in 2020-2021.

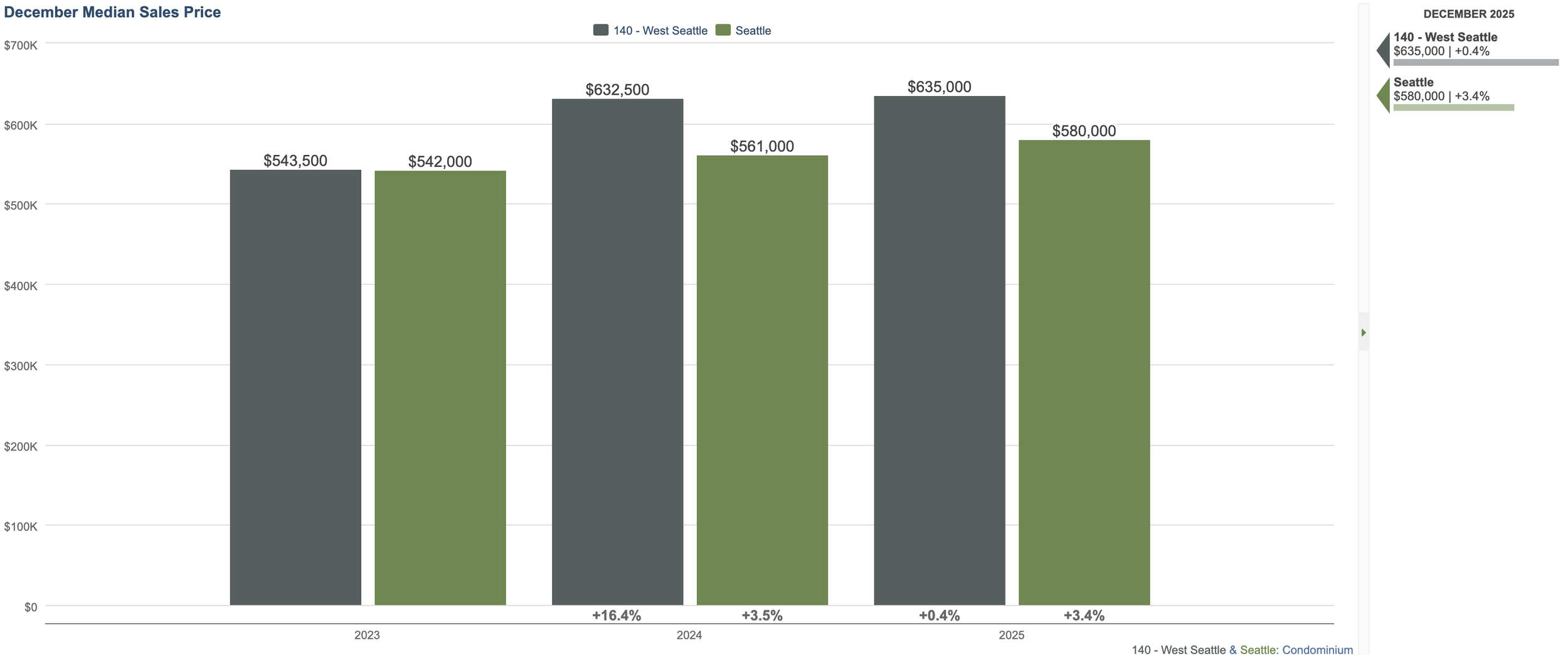

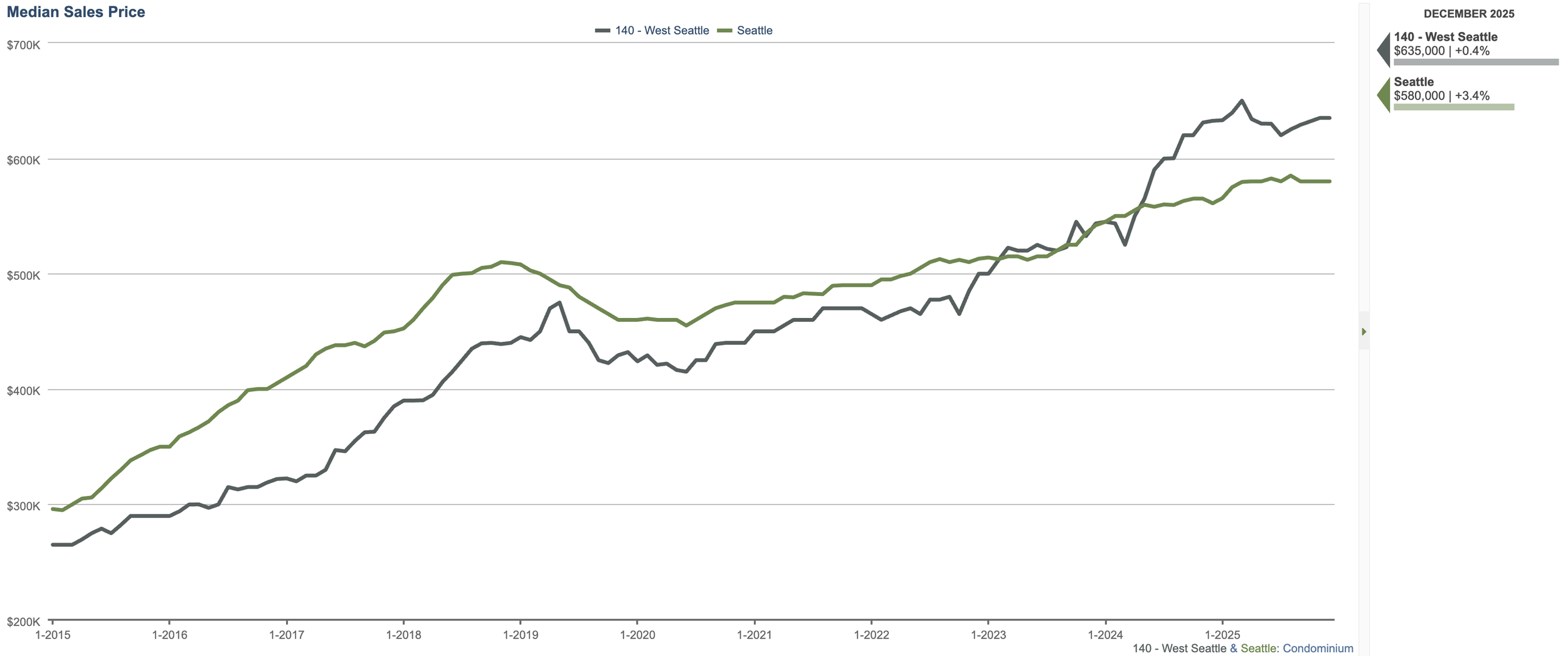

Condo - The overall Median in West Seattle was 635k. The condo market gets a bit skewed as New Construction Home/ADU/DADU and townhomes have been classified as condos the past couple of years. They may have Articles of Incorporation and HOA’s but might not have dues and rules®ulations like traditional condo buildings we are more accustomed to.

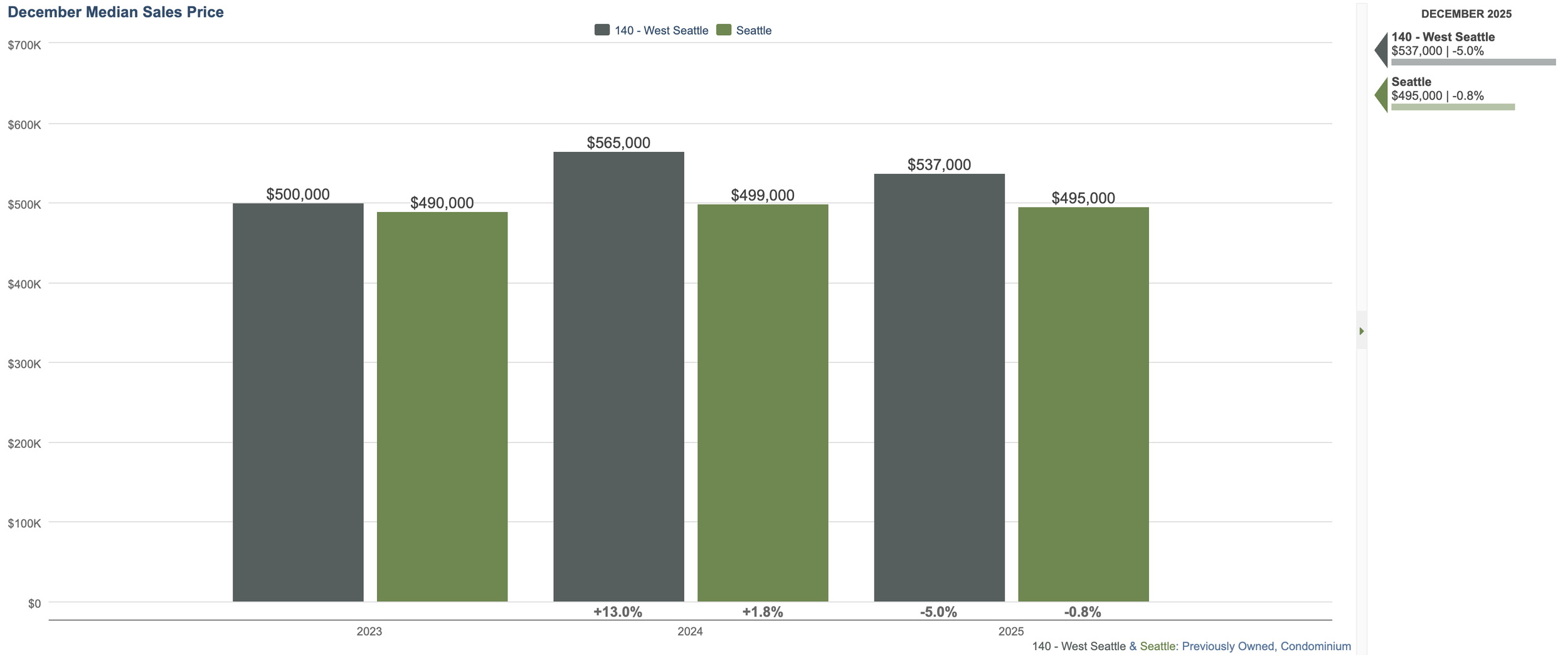

Previously Owned Condos - We can exclude New Construction projects to get a better idea of more traditional condo style unit. That median would be 537k.

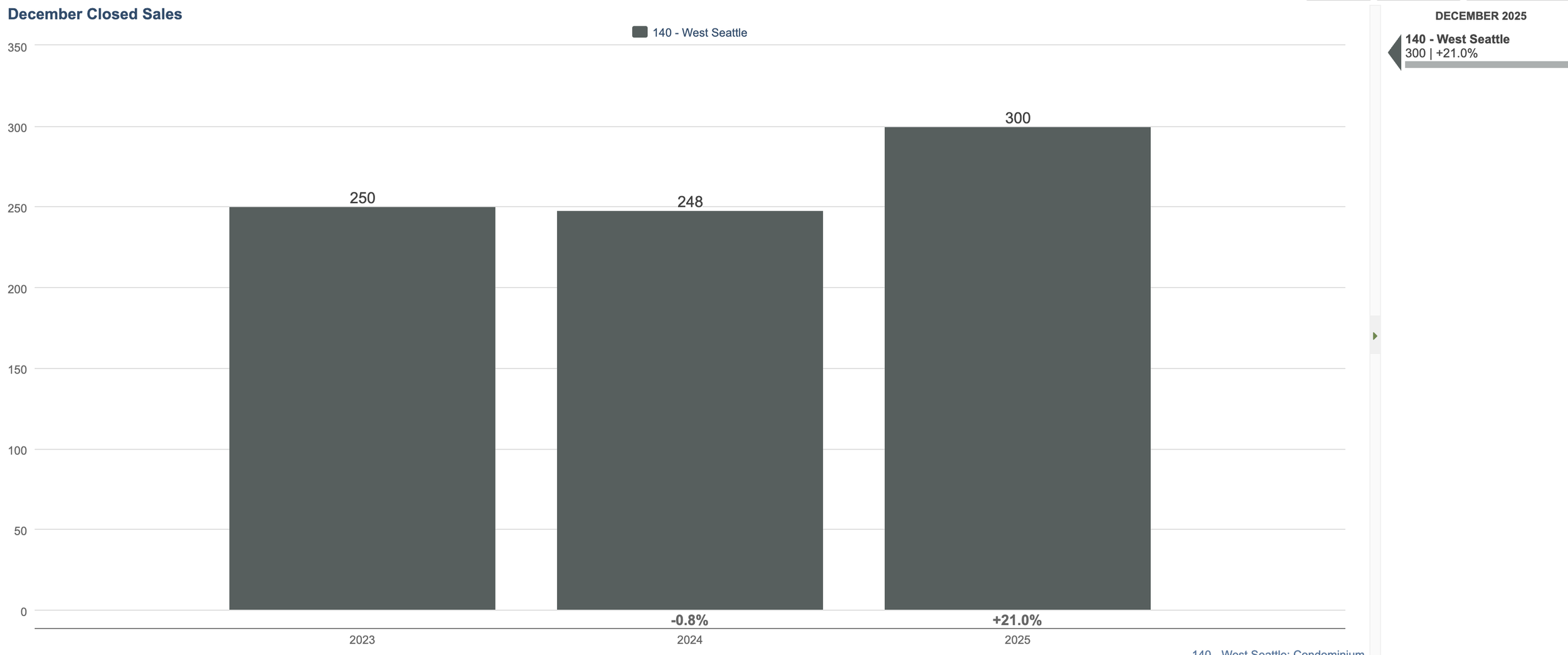

There were 300 condo sales in WS (including new construction) in 2025. 194 of the 300 were previously owned (not new construction). Overall, the condo market has been a tougher environment than the residential market.

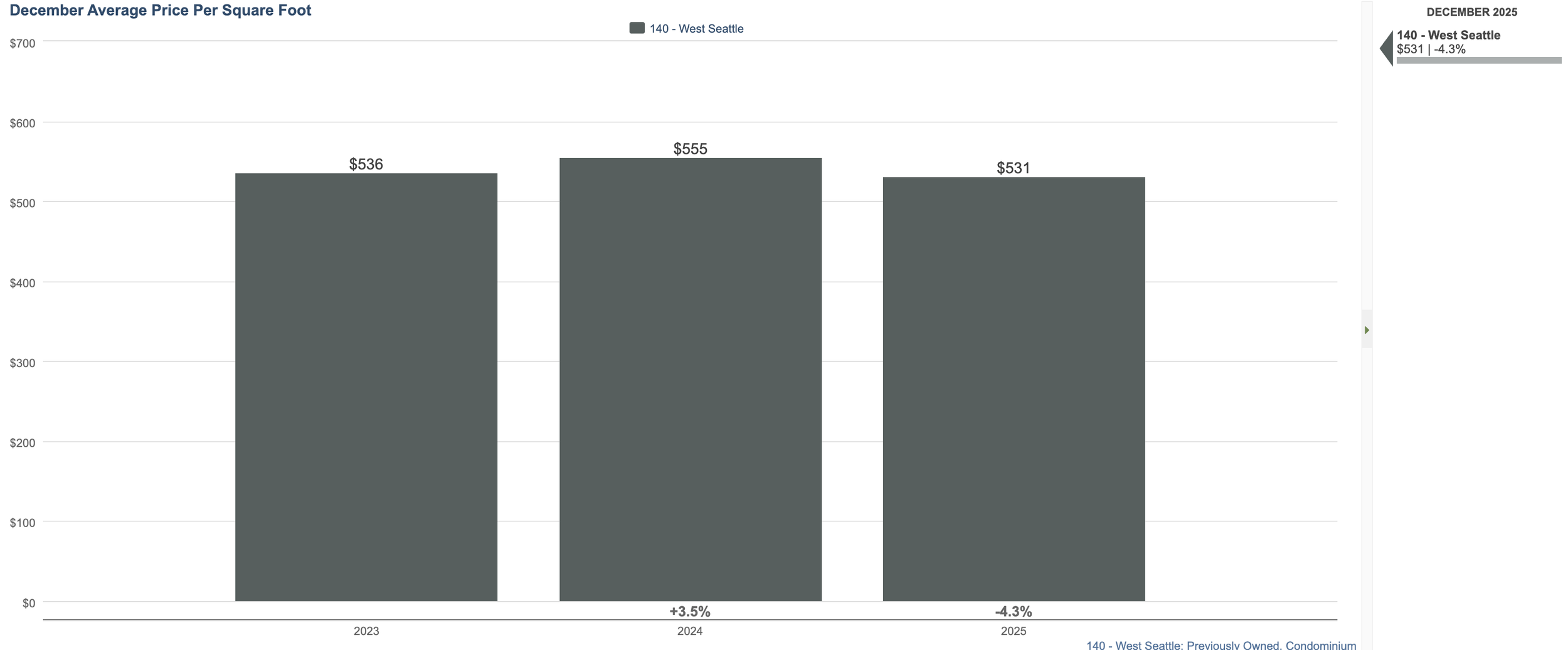

Price per square foot has stayed relatively stable the past couple of years.

Previously Owned $/sf was at $531. The new construction units tend to be stacked (2 and 3 level), between 1000-20000sf, but really efficient floor plans. Previously owned are typically that 1-level floor plan that we are accustomed to.

Overall, the condo market has modest gains, compared to the residential market, over the past 10 years. It is a more challenging market to buy and sell in.

This graph shows a rolling 12-month average and takes out the wild month-to-month swings we typically see.

Overall, 2025 felt a lot like 2024 and 2023. We did see more inventory but a lot of it was new-construction Homes/Townhomes/ADU/DADU. Previously owned homes closed sales were pretty close to the previous 2 years. We felt we might see more sellers, who had been previously locked into their low interest rates, finally decide to put their home on the market in 2025 but the numbers were similar to 2023-2024 (at least in West Seattle). Rates have finally fallen to around 6% so will watch if that is driver for home owners to finally list in 2026. We’ll discuss 2026 predictions in the next post.

2025 Market Tidbits -

Most expensive House - 9325 Fauntleroy Wy SW, Seattle, WA 98136

Home closest to Median Price of 850k - (note- 20 homes sold for exactly 850k) - 7901 12th Ave SW, Seattle, WA 98106

Home closest to Avg price of $991,671 - 5440 44th Ave SW, Seattle, WA 98136-1104

Most expensive condo - 1250 Alki Ave SW #PHG, Seattle, WA 98116

Condo closest to Median Price of 616k - (note - would have been a townhome in other years) - 4839 B 42nd Ave SW, Seattle, WA 98116-4508

Condo (previously owned) closest to Median of 682k - 4527 45th Ave SW #401 N, Seattle, WA 98116-4196