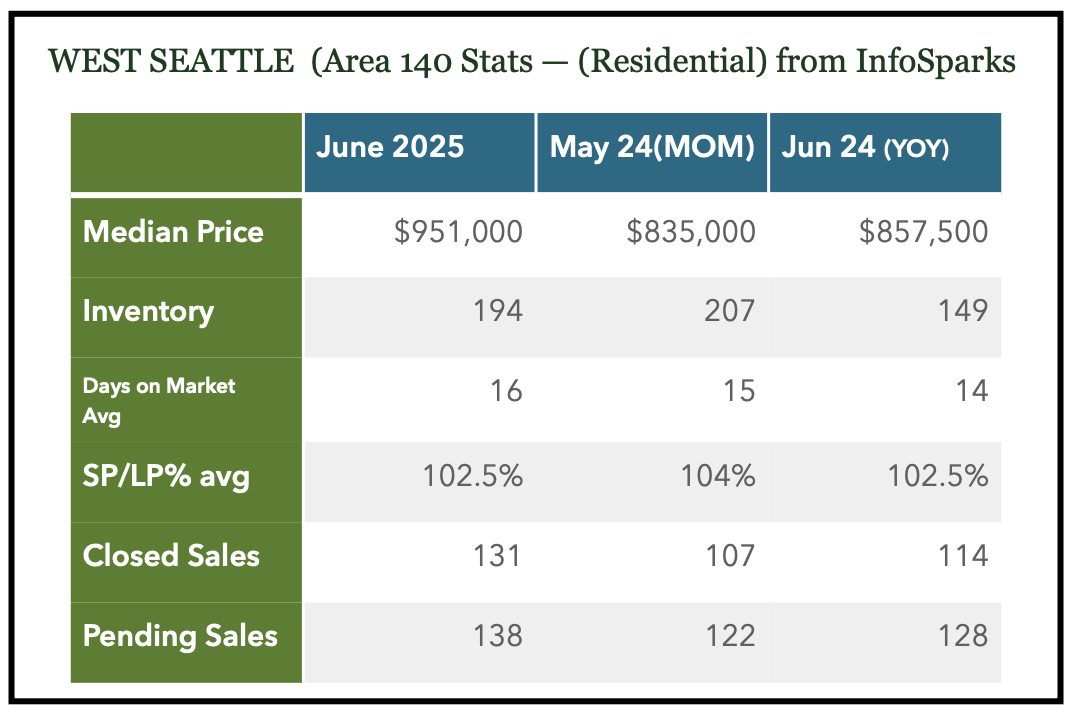

July 2025 Market Update

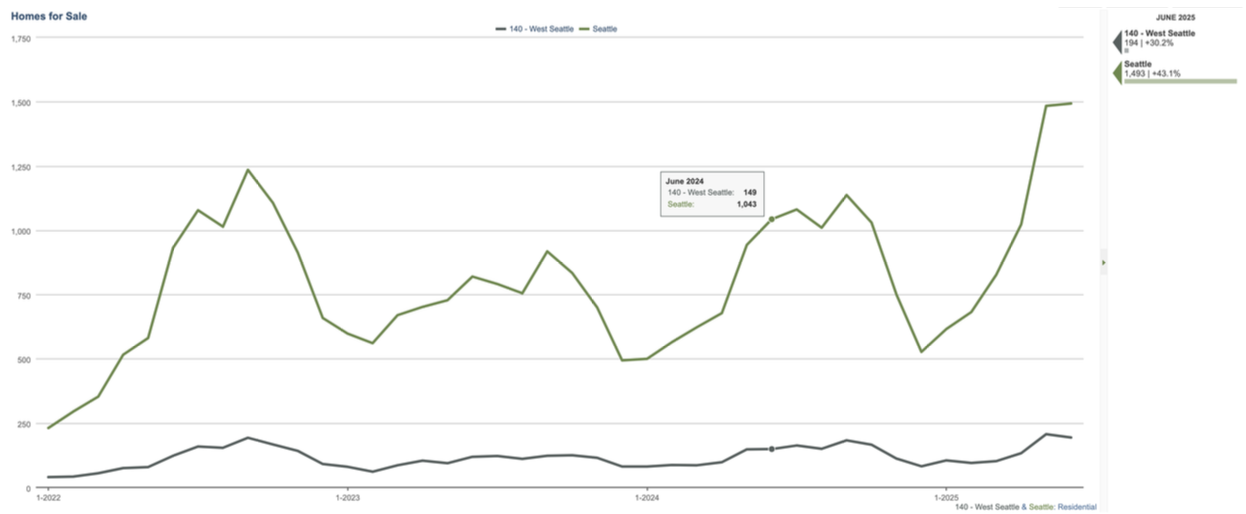

June numbers are in and show a pretty strong market. The Seattle Times headline for last months numbers was “Seattle-area home prices ‘defying gravity’ even as demand wanes”. In a sense, it does defy gravity and logic. Higher prices, higher interest rates, economic uncertainty and political upheaval should make the market more tepid. And, in some areas outside of Seattle that is probably the case. But for the most part, in West Seattle and Seattle Metro, Median Price is strong, and Closed and Pending Sales are up or steady. Inventory is at its highest level in years. But even with more inventory and leveling off in the number of sales, it hasn’t meant a decline in Median Pricing.

I think most of us at West Seattle Realty think this is a more balanced market but it is a bit tricky. Buyers are more picky for the right things in a home or targeting particular price ranges. One of our brokers shared a story of a home her clients were interested in Hawthorne Hills, in North East Seattle. It was priced at $1.5M, received multiple offers and will sell near $2M. She had other clients who toured multiple homes, in West Seattle, in the $800k range and nothing checked all the boxes so they haven’t written an offer. And those homes are still on the market. Another broker has a condo listing below $400k and traffic has been slower than expected. So, while it may be a seller market for homes over $1M, its balanced or Buyer’s Market for homes under. A very strange market indeed.

But also, its a market that follows some seasonal trends. Every year, inventory rises this time of year. Urgency from buyer wanes from beginning of the year as they bought a home or may shift their focus to other things (summer vacations) if they didn’t. It could also be the best inventory is listed in the earlier part of the year and we get more sales that time of the year. Pricing typically dips as we get into summer but we have seen the occasional blip, like this year. This will be a number to watch the rest of the year. And, it could just be that the over million buyer pool will drive the market. That buyer pool typically can afford more on down payments, monthly payments and can often have more lending options (buy without selling).

Median Price - Median Price last month peaked at an all time high for West Seattle and Seattle Metro. Compare to spring (April) 2022 when interest rates were 5% (up from 3.22% in January 2022). Interest rates this past month were in the high 6%’s.

It’s interesting to point point out that in April 2022, a house costing 1M, with 20% down, would have a payment of $3,468 (P&I only). In 2025, with interest rates at 6.678% a payment would be $5,150 (P&I).

Inventory - Inventory numbers were slightly flat last month but might be more a case of when the month ended and how listings typically don’t come out around the holiday. Still, they are up this year. Average Days on Market for active properties is 42. While the Average Days on Market for Solds (in June) was 15. So, new listings are either selling quickly or sitting awhile. There might be a reason those homes are sitting, either condition, location or pricing. Also, New Construction projects can sit a little longer than a traditional home with lot. They are about 20% of the available inventory.

We also thought, earlier in the year, that we would see an increase in listings this spring as sellers finally were done waiting for lower interest rates (locked in effect), elections to pass or tired of being a landlord. That has somewhat played out.

Another take away, new listings were down in June, 171 compared to 218 in May. We felt the market was going to get the most listings right after Spring Break this year (it was at the end of April) and this proved to be the case. We’ll watch to see what new things hit the market, especially looking at previously owned or new construction projects. About 45 of the 194 available homes are new construction. These projects sales activity have slowed a bit, especially the smaller DADU units in the back.

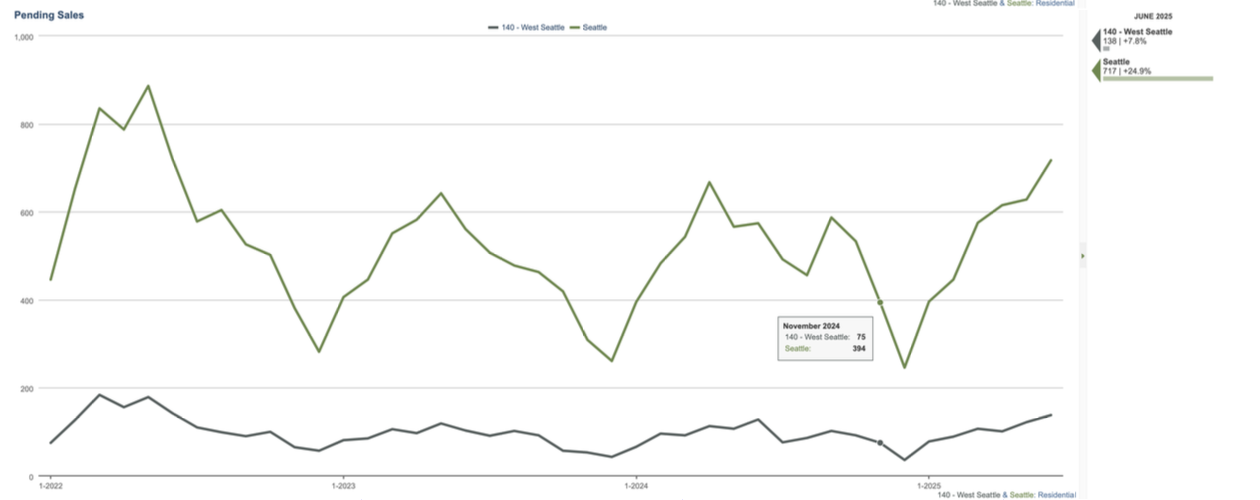

Pending Numbers - June was a pretty busy month. We saw a rise in numbers last month were we had typically seen the peak in May or April, in past years. This could be because of the late spring break and the market got extended a little. We’ll watch and see if July doesn’t fall back to seasonal trends.

Closed Sales were up in the past month. That’s a pretty busy month also taking into account the solid May Pending numbers. We’ve watched the local news report stories of a slowing and sluggish market the past couple of weeks but sales are fairly in line with seasonal trends, at least in Seattle. Closed Sales typically peak in May and then we start to see numbers decline as we get into summer and later in the year.

Of note. the 131 closed sales last month, 61 received higher than 100% LP/SP ratios, 35 received 100% LP/SP, 35 received less than 100% LP/SP.

To note, there was a solid decrease in numbers in 2022. Closed sales peaked in June of 2022 and declined after. That coincided with a fixed rate mortgage rising above 6% for the first time since 2008. That was about the last time rates have been under that number as interest rates have hovered between 6 and 7 percent since then. Buyers have seemingly adjusted to the new normal.

Seattle Metro Median Price was at a recent all time peak at $1,037,000. Previous highs were in April of this year and spring of 2022 (right around 1M). Closed and Pending numbers were over the previous month and a year ago. Inventory is definitely higher than a year ago. About 20% (354 of 1493) of that is New Construction projects (Home/ADU/DADU/Townhome).

Interest rates remain high (compared to past several years) with a Conventional loan product of high 6’s.