June 2025 Market Update

The West Seattle market stayed fairly strong in May but we started to sense some changes. We got a sense that the strong spring market is wrapping up and things are starting to balance out and that the needle may even start pointing towards buyers in the coming months. This typically happens as we get deeper into spring as we see more inventory and demand wanes. It just might have come a little earlier this year. Sales are still strong-ish but we started to see inventory build and less competitive offer situations.

Median price dipped slightly after a strong April. Median has bounced around the last couple of months so too early to call it a trend. Median price has typically peaked in April and May as higher demand and lower inventory conditions exist. It is also the time of the year where we see some of the better inventory and more competitive offer situations. However, summer months typically brings more inventory and less urgency so will watch.

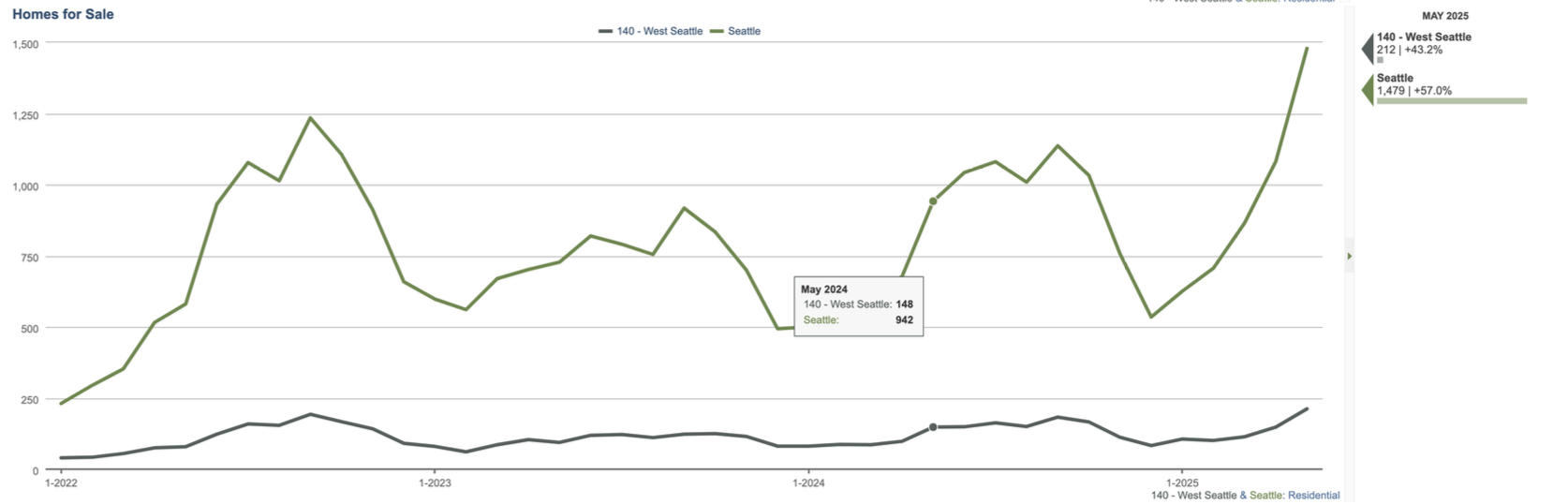

Inventory levels typically rise as we get past spring break which was in late April this year. We saw an influx of homes hit the market in May including a lot of previously owned homes (vs. New Construction Home/ADU/DADU). 195 previously owned homes hit the market in May.

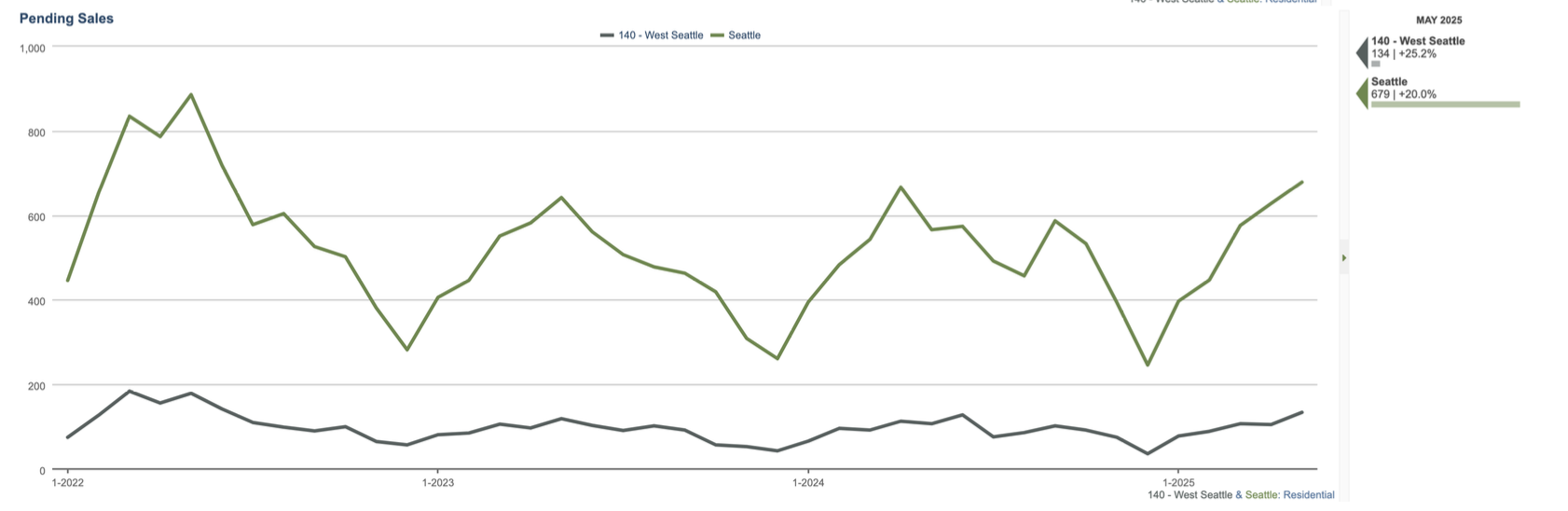

Closed homes leveled out and were below previous years. While demand appears solid (price, sales and pending numbers were on trend) we did feel a slight shift this month. Our agents had a couple of buyer representations that went into offer situations, expecting multiple offers, only to be the only one. June and July will be an interesting months to watch as we usually see numbers trend down. Closed sales tend to be more reflective of the previous month’s activity.

Pending numbers are still strong but typically peak late Spring-early Summer. We would expect that trend to continue and homes going under contract to level out or decline (unless rates magically drop).

Other points of interest -

Days on Market average rose to 16 days. While many homes still received offers on review dates (or before) we did see more homes pass the review.

Average Sales Price-List Price ratio was at 104%. This is a good indicator for sellers and about on par with the past several years (but down from May of 2022 when it was 113%.

43 of the closed sales received more than 100% of list price. 26 received less than 100% of list price. Homes that presented well (thoughtful pricing, pristine condition and strategically marketed) did really good. Homes that couldn’t (over priced, little market prep and owner occupied) often sat on market longer and sold for less money.

Typically summer months bring a more balanced market. Coupled with higher rates and economic uncertainty, we might see a changing market the next couple of months. Months Supply is at 2.3%, its highest point in years (meaning it would take almost 2 1/2 months for all inventory to sell if nothing new came on market. Seattle metro is currently at 3 months supply and climbing. It does seem that sellers that had been waiting the past couple of years (locked-in effect) are now putting their homes on market. But, buyers can’t afford as much with rates in the high 6’s and low 7’s. Still the local job market remain strong and we should see moderate demand. Pricing right and offering preferable condition will be super important for sellers. Also, expect a little negotiations in the upcoming months..

Condo prices dipped down but they can vary more than residential homes sales. They could be swayed more by a higher closed sale on Alki or now Home/ADU/DADU, classified as a condo, data is lumped in. There were only 21 closed sales recored in May (vs. 33 in March when price peaked) so smaller sample size. Of note, 21 of the 33 sales in March were new construction so likely Home/ADU/DADU or townhome (21 of those were of that property type).

Seattle Metro dipped a bit but April was really strong. Inventory numbers took a big jump with most of those being previously owned homes. There was a 1,112 previously owned new listings last month. It’s a big jump, 32% over last year and similar to June of 2022. Something to watch in the couple of months. More supply and lighter demand couple shift the market we have been experiencing the past couple of years.

Interest rates rose to about 6.85% last month. They are expected to stay at these levels for the foreseeable future.

Fannie Mae projects rates staying the 6’s the rest of the year into next. We have seen some seller paid rate buy downs and that could be more common with a more balanced market.