December 2025 Market Update

November numbers are in and while they show steep declines from the previous month they are right about where they were a year ago and are following seasonal trends. November and December are typically the months when the market slows a bit. It’s darker and wetter so homes don’t show as well and there is less buyer urgency. And, people’s attention seem to turn to other things as we get between holidays. Closed and Pending sales numbers both retreated from previous months activity. Homes tended to sit on market longer and Sales Price/List Price ratios are lower as there can be more room for negotiation. We did see inventory drop as we received less ‘New’ listings coming to market, homes receiving offers and others being pulled (maybe to be re-listed in Spring).

The overall trends were pretty positive for the year. 2025 is not in the books yet but we saw moderate price gains and increase in inventory and sales. We'll have an end of year review next month and take a deeper dive. We will also start turning our attention to 2026 and look at factors that could effect the market. Spring Break (a market turning point) is earlier next year and Seattle is expected to host upwards of 700k soccer fans in June-July which could shift market timelines.

Median price saw a huge dip from the previous month, of almost 100k. But, you can see October’s price of 932k was an almost match of the year’s peak of 950k in June. September and early-October generally represent the second selling season and we saw a pretty brisk market. End of October and into November we typically see less transactions and less competitive offer situations. 8 of the 75 closed transactions had SP/LP ratios of over 100% compared to 26 of 100 in the November closes. There also appeared to be more seller concessions (closing cost, lender credits or inspection items).

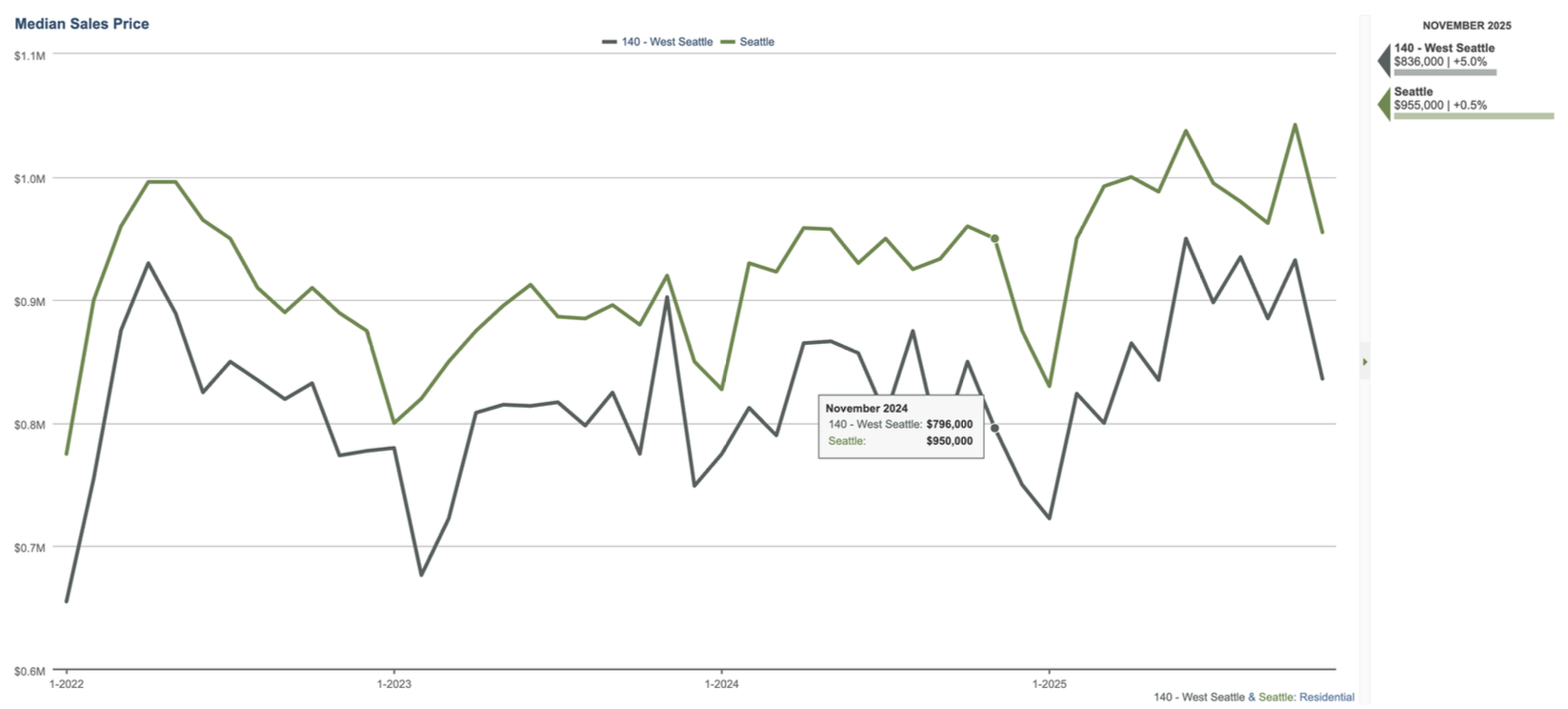

In most Fall markets, we can see big drops in Median (see Fall of 2022, 23, and 24) but the market is not in free fall. The below graph is a Rolling 12 month aggregate vs. the month-to-month data we use in the monthly update. Since the middle of 2023, West Seattle has had moderate price gains and typically follow seasonal trends. It has been good for sellers (especially residential owners) who have seen equity builds. And, good for buyers, who don’t want to experience a huge drop in equity right after buying. We have all heard of the economic uncertainty (affordability, local layoffs, rates, etc…) but so far the overall market is doing ok.

Inventory took a big dip from the previous 2 months. This can be a couple of different things.

Houses either received offers and came off market, 175 closed and another 73 under contract the past 2 months.

We see less ‘new listings’ coming to market in November. November had 77 new listings last month compared to 120 in October and 160 in September.

And some homes Cancelled and we may see them come back to market in the Spring.

Another tidbit on inventory. 162 available homes is still relatively high compared to inventory numbers the past couple of years. But, only 102 of the homes are considered ‘previously owned’. There is a big chunk of homes for sale that are of the New Construction variety. These are the 3 packs or townhome style homes. There are 61 available compared to 36 a year ago (up 70%). If you look at Seattle Metro, 425 of the 1,141 Homes for Sale are New Construction. There has been a lot of construction (putting 3 or more homes where there only used to be 1) the past couple of years and they have come to market this year.

Closed sales were down in November and followed seasonal trends. We’d expect December and January to act accordingly before rising in February through the spring.

Pending numbers were in-line with previous years activity.

Seattle Metro numbers mirrored West Seattle. Median prices dropped, less available inventory and less Closed and Pending Sales. This past month looks a lot like last year.

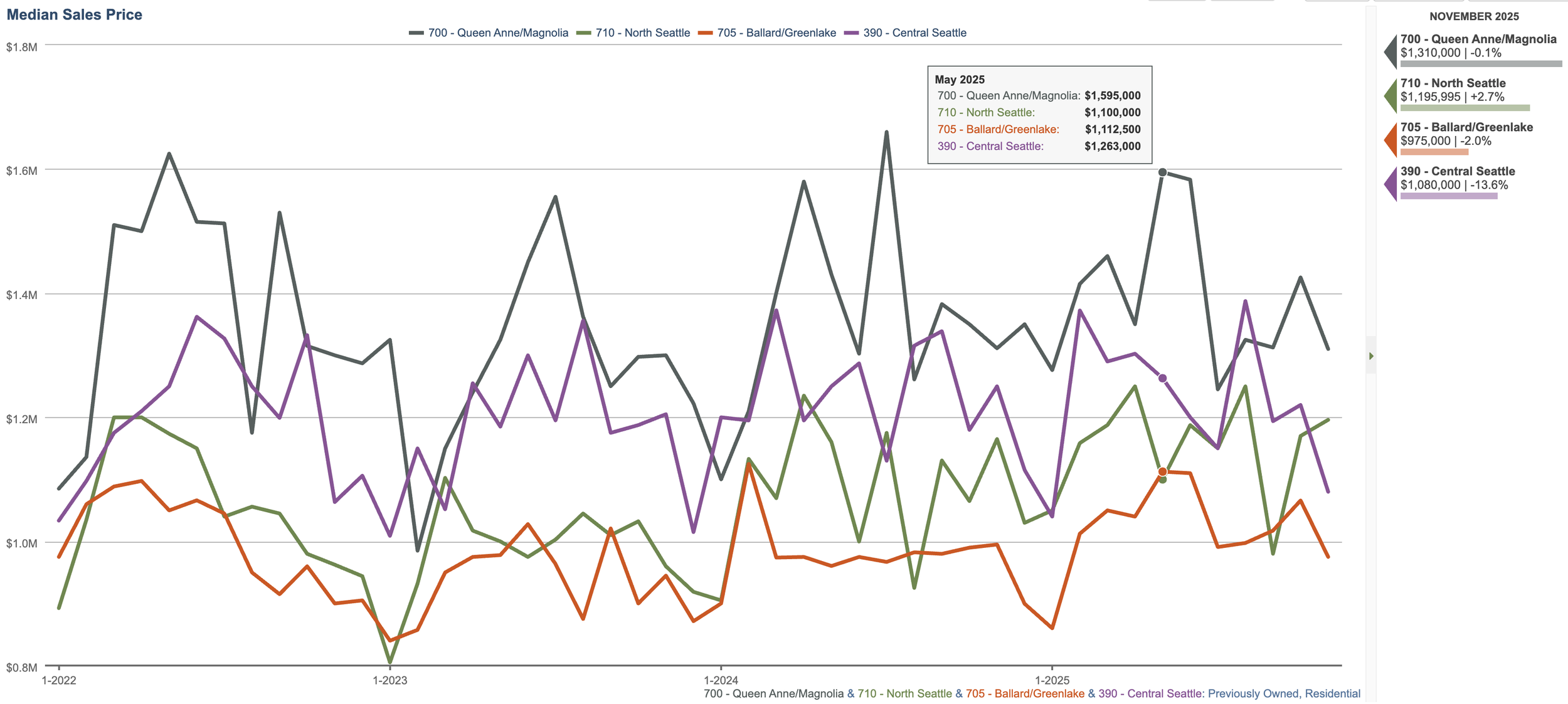

Most other areas in Seattle Metro followed the same seasonal trends last month. Here are areas North and East of Downtown. Sure make West Seattle look like a bargain;).

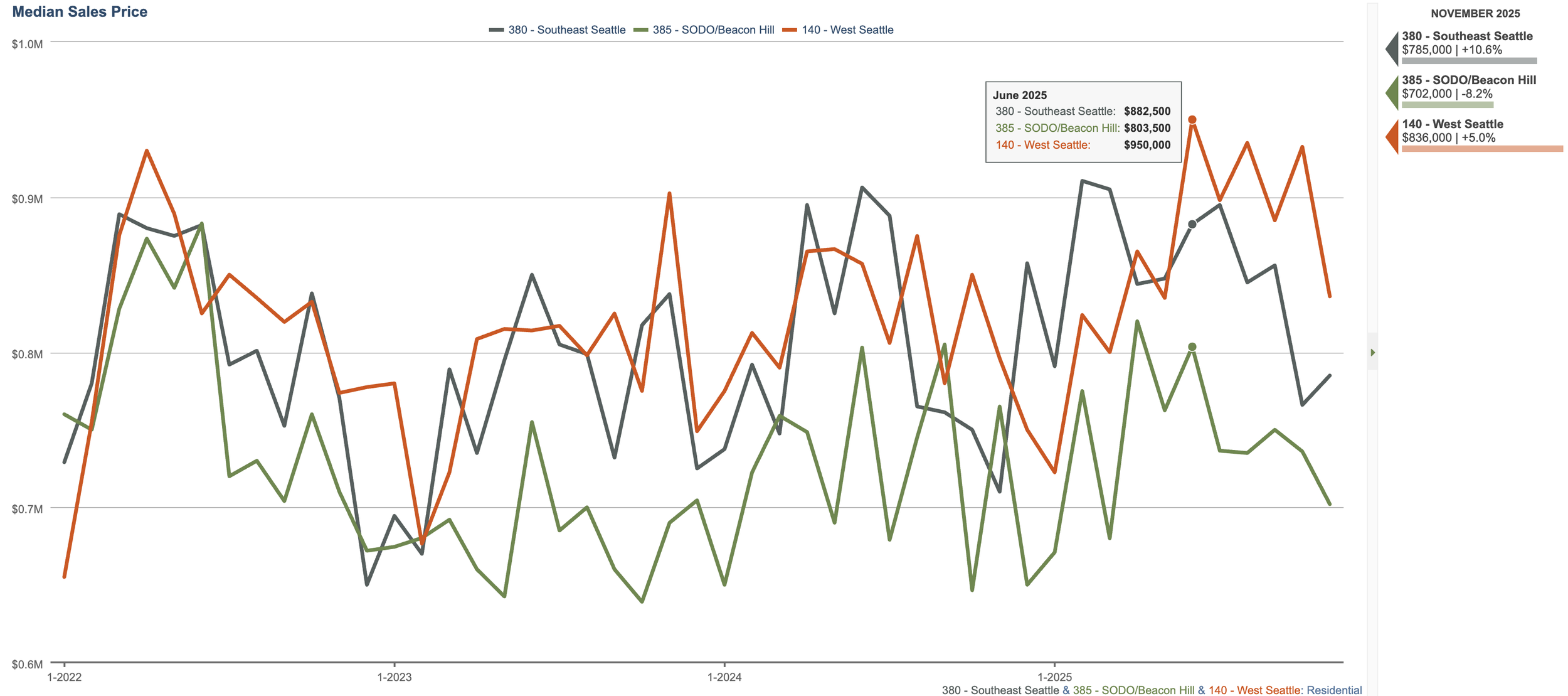

And here is South of Downtown (including West Seattle).

And King County and the entire MLS (WA State) while we are at it.

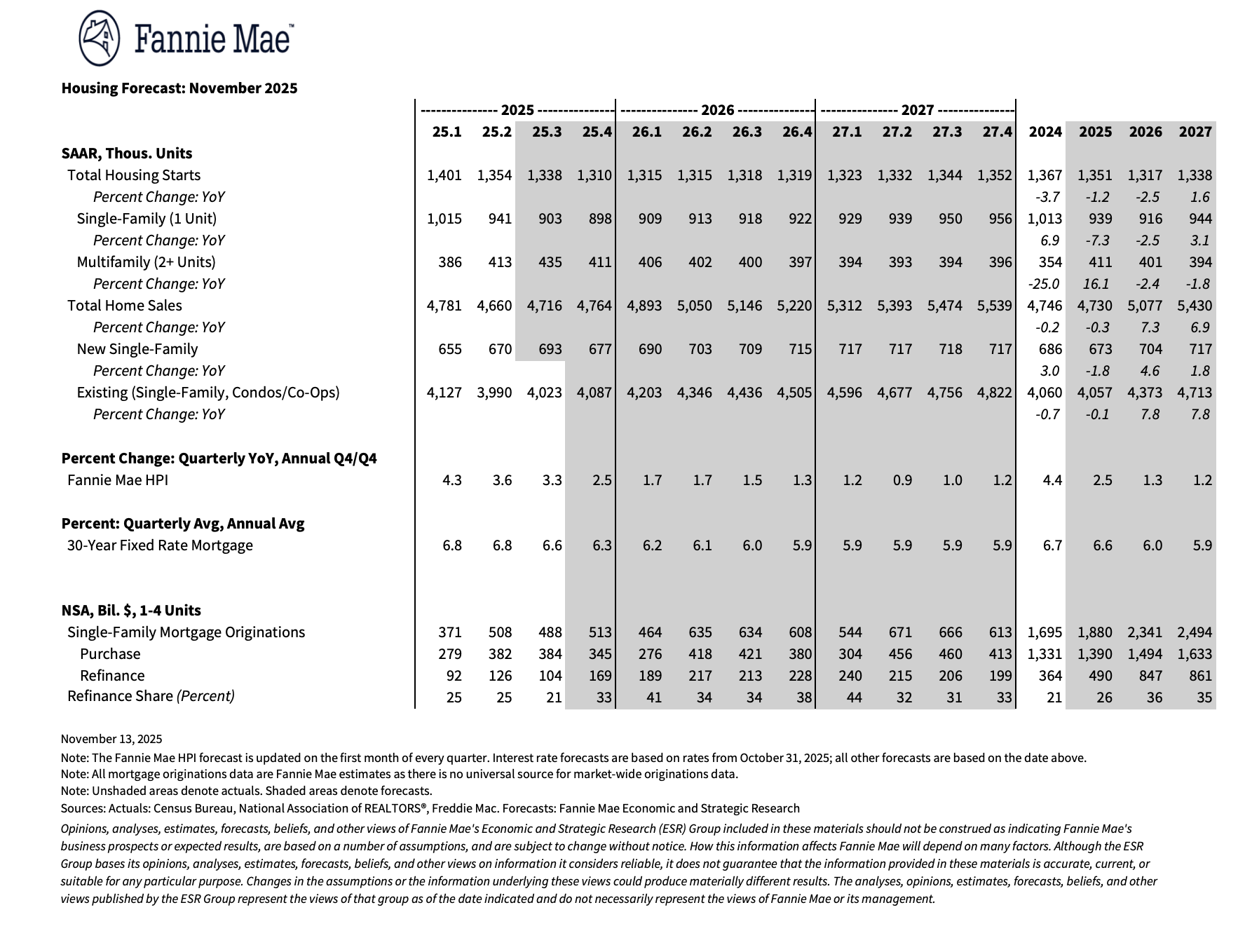

Rates were in the low 6’s this past month but didn’t seem to be a huge driver in more activity. Lowering rates typically mean something in the economy is pushing them there (inflation, job numbers). The Fed meets once more before the end of the year but we’ll likely be looking to next year before anything major happens. Here is the November Fannie Mae November Housing Forecast. They anticipate rates in the low 6’s and for sales to increase.