November 2025 Market Update

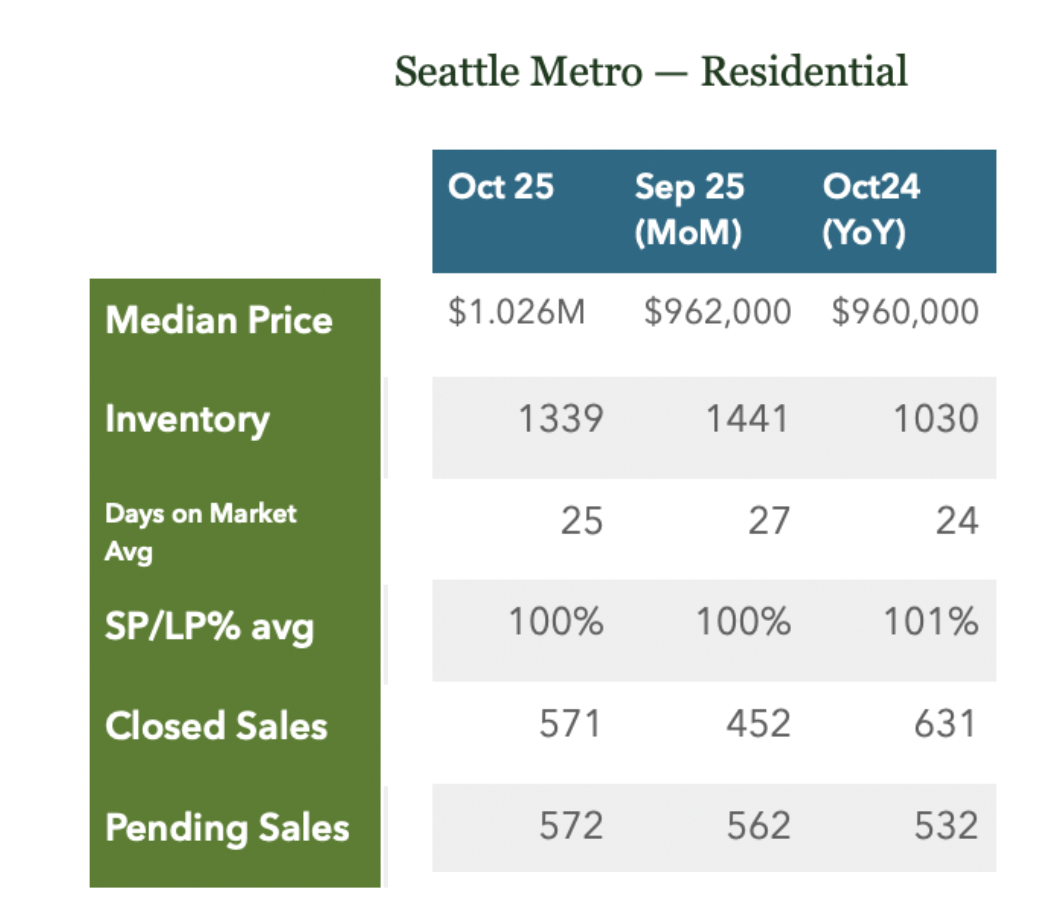

We set our clocks backs and atmospheric rivers are returning, so we must be officially be in Fall. October numbers, for West Seattle, are in and show typical seasonal trends. Median price was up from September and the same time last year. Closed and Pending sales were up from the previous month and Days on Market stayed about the same. It does feel like certain price ranges or styles of homes are performing better than others but numbers indicate similarities to 2024 and 2023.

Median priced had a big bump from September (932k vs. 885k). We saw bouncing spikes in Median pricing after a couple months from the year high peak in June of 950k. This follows trends from previous years, happening in 2022 and 2024. In 2023, the spike occurred in November. 2022 was the year that interest rates climbed from 4 to 6’s so isn’t a good comparison. Closed sales are often reflective of the previous month’s activity. It can take 21-30 days to close traditional sales so if a property went under contract in September it likely closes in October. Most years we see Median pricing peak in early summer and then level out until or drop until the ‘second’ selling season in early Fall. August is historically a slower month (last summer vacations and back to school) so September’s number might be a little sluggish, even though it’s a really active month. Whatever the factors, the October’s Median (932k) wasn’t that far off the year peak of 950k in June. October (and September) didn’t feel like June (and May) in terms of market pace but not far off.

Inventory numbers fell off a bit from the previous month but up from a year ago. Pending numbers were up (more houses coming off market) and New Listings were down (121 in October compared to 161 in September). This is typically the time of year where inventory is at its peak. We would expect numbers to drop as we head into winter months. A year ago, only 48 new listings came to market in November (and 64 the year before that).

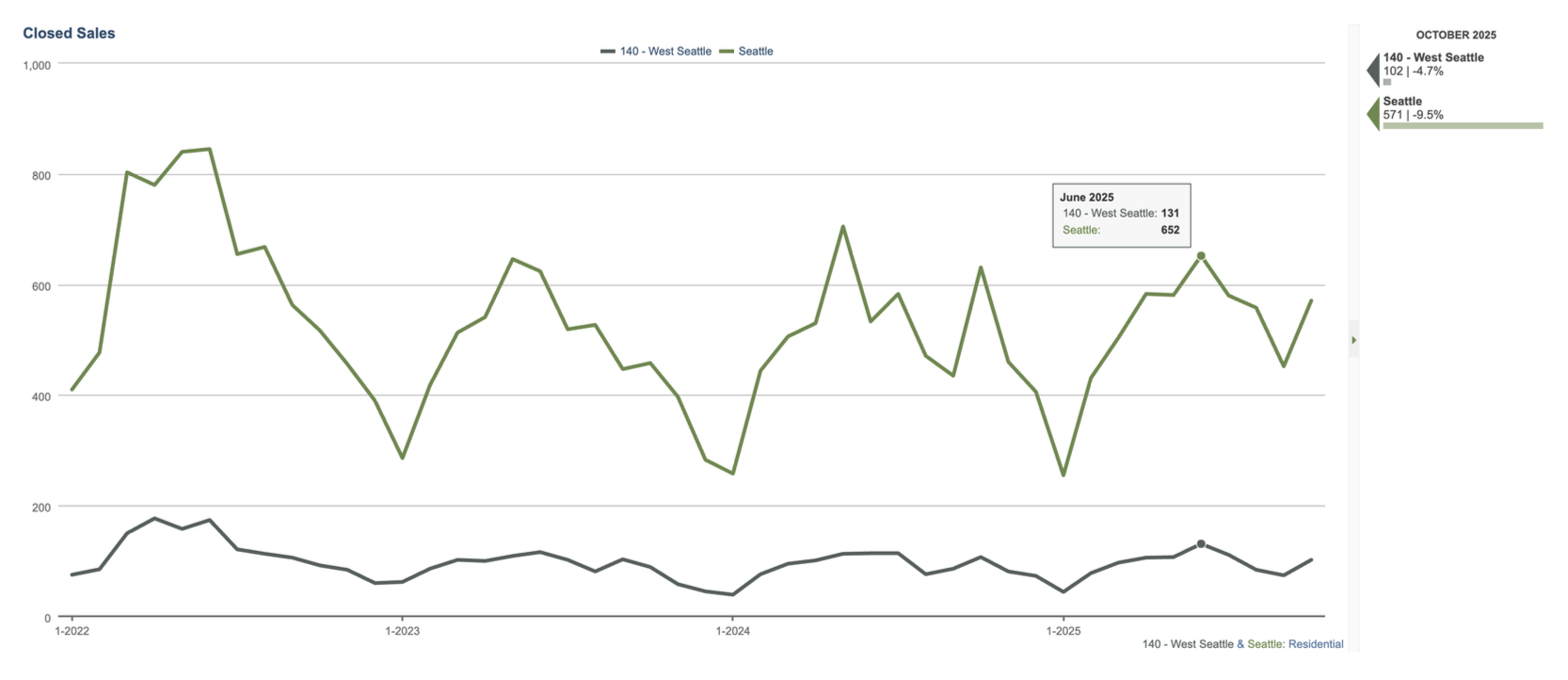

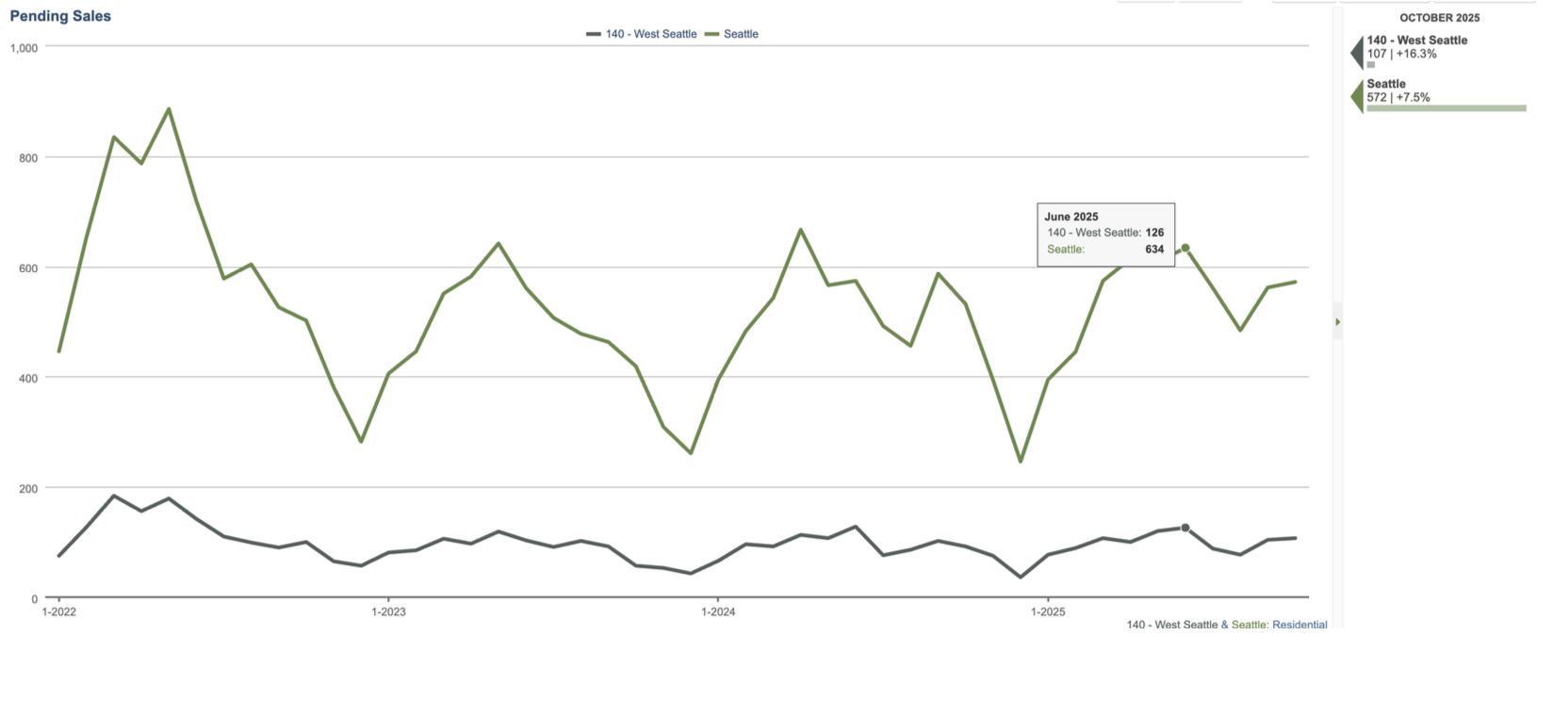

Closed Sales spiked up to 102 from 74 from the previous month (as mentioned, this is likely September and early October’s listings). This is about where the market was a year ago (107 in 2024). The market does feel different from a year ago but the numbers show roughly the same. About 23 of the 102 received higher than 100% of list (so less competitive than spring) and 37 had a sales price less than list price (indicating some play in price). This doesn’t account for built in seller concessions or inspection requests but does show a more balanced market. The Months Supply in West Seattle is 2.2 months, meaning if no new inventory came to market it would take 2.2 months for everything to sell. This would indicate a Seller’s Market (4-6 months is a balanced market or even a buyer’s market) but we wouldn’t call it that right now.

Pending Sales remained pretty strong. Interest rates have dropped the beginning of the year, about 6.25% today. This has helped new homebuyers, a little, but also helped buyers from a year ago, who bought at near 7%, who are now refinancing. Typically, Pending number will retreat as we head into winter as there is less new inventory and attentions turn to other things. November and December represent peak lows in homes going under contract almost every year for the past 10 years.

Seattle Metro and West Seattle mirrored each other last month. Higher median, slightly declining inventory, closed sales up and similar Pending numbers from a year ago. It remains to be seen how the Government shutdowns and local layoffs will affect the market. We would probably get a better idea in the spring market where maybe there could be less buyers, more inventory and less urgency. For now, 2025 seems a lot like 2024 and 2023.